Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Analysis: Upward Rebound Gains May Remain Weak

- 【XM Market Analysis】--WTI Crude Oil Weekly Forecast: Finds a Strong Bottom At $6

- 【XM Group】--Gold Analysis: Bulls Await More Stimulus

- 【XM Decision Analysis】--GBP/USD Forex Signal: Double-Bottom Chart Pattern Forms

- 【XM Forex】--ASX 200 Forecast: Gains Pre-RBA

market analysis

Powell remains patient, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on June 25

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "【XM Group】: Powell maintains patience, and short-term trend analysis of spot gold, silver, crude oil and foreign exchange on June 25." Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market conditions

The three major U.S. stock index futures rose and fell mixed, Dow futures fell 0.08%, S&P 500 futures rose 0.03%, and Nasdaq futures rose 0.16%. The German DAX index fell 0.52%, the UK FTSE 100 index fell 0.03%, the French CAC40 index fell 0.44%, and the European Stoke 50 index fell 0.45%.

2. Interpretation of market news

Powell remained patient, but the risk of interest rate cuts in July still exists

⑴ At Tuesday's semi-annual hearing, Federal Reserve Chairman Powell did not provide much new information on the outlook for interest rates, and maintained his wait-and-see attitude and was in line with market expectations. ⑵ Although Powell did not repeat recent dovish remarks from Fed governors Christopher Waller and Michelle Bowman, he hinted that the Fed may cut interest rates earlier than expected. ⑶ The current interest rate market has been fully included in the expectation of a rate cut in September, and the possibility of a rate cut in July is about 20%, which cannot be xmmarkets.cnpletely ruled out. ⑷Powell pointed out that if interest rates are cut in July, we need to see weak labor market and less than expected inflation. ⑸ This increases the importance of the next US employment and CPI data to the market, because at present, the July interest rate cut will be a dovish impact, which is not good for the US dollar.

NATO allies agree to increase defense spending targets Reaffirming collective defense xmmarkets.cnmitments

On Wednesday, NATO allies promised to increase annual defense spending to 5% of GDP by 2035, and reiterated their xmmarkets.cnmitment to collective defense, saying that "an attack on one member state is an attack on all member states." existIn the Hague summit declaration, NATO leaders said that defense xmmarkets.cnmitments will include investment in core defense demand that accounts for at least 3.5% of GDP each year, and also pledge to use 1.5% of GDP for security-related spending, including protecting critical infrastructure and strengthening the coalition’s defense industrial base. The leaders said these investments were needed to deal with “deep security threats”, particularly “the long-term threat posed by Russia to European-Atlantic security and the ongoing threat of terrorism.” Progress in the expenditure increase target will be assessed in 2029. Allies reiterated their support for Ukraine's "lasting sovereignty xmmarkets.cnmitment" but did not mention the issue of Ukraine's possible accession to NATO in the future, which was mentioned in some previous summit declarations.

Russia said that Iran's suspension of cooperation with the International Atomic Energy Agency is understandable

Russian President's Press Secretary Peskov said at a media briefing on the 25th that in view of the inaction of the International Atomic Energy Agency during the United States' attack on Iran's nuclear facilities, Iran's decision to suspend cooperation with the agency is "understandable". Peskov said the IAEA did nothing during the U.S. attack on Iran's nuclear facility, seriously damaging the agency's reputation. Russia is closely monitoring the situation in the Middle East and maintaining ties with Iran.

Powell's hearing information is limited, and the market is concerned about the direction of interest rates

⑴ Federal Reserve Chairman Powell did not disclose much new information at the House of Representatives' semi-annual hearing, reiterating that policy makers do not need to rush to adjust monetary policy, and can wait for the impact of US trade policy to emerge. ⑵Powell admitted that the impact of tariffs on inflation was lower than April expectations, which could lead to a cut in interest rates earlier than expected weeks ago, according to Michael Pfister, a foreign exchange analyst at xmmarkets.cnmerzbank. ⑶ The market has currently included expectations of additional interest rate cuts. ⑷Federal Director Michelle Bowman argued on Monday that if inflationary pressure is moderate, interest rates should be cut in July, causing a sharp depreciation of the US dollar. Federal Reserve Director Christopher Waller has made similar remarks before, believing that the federal funds rate is 1.25-1.5 percentage points higher than the neutral level, and both of them are Powell's successor candidates next year. ⑸ Other decision makers recently refuted that the Kansas City Fed chairman is not in a hurry to cut interest rates and tends to wait and see the impact of US tariffs. Federal Reserve Director Michael Barr also emphasized that the real economy is in good condition at present. ⑹If future inflation data do not show the greater impact of US tariffs, fierce discussions on interest rate cuts may begin in July, and then interest rate cuts may accelerate again. Since last week, the market has included an additional rate cut of about 12 basis points by the end of the year, and this number may rise if the Fed's internal consensus continues to collapse in the xmmarkets.cning weeks, which does not bode well for the dollar.

The CDS spread of Israel's 5-year Treasury bonds fell to a 12-week low

⑴ After Israel reached a ceasefire agreement with Iran, the cost of insured Israel's 5-year Treasury bonds dropped to a 12-week low. ⑵ The easing of the Middle East conflict has boosted market sentiment and stimulated the market's preference for risky assets. ⑶S&P Global Market Intelligence Data shows that Israel's 5-year CDS spread fell by 6 basis points to 91 basis points.

Hungarian Prime Minister Orban made a series of statements involving EU defense and the situation in Russia and Ukraine

⑴Hungarian Prime Minister Orban delivered a series of important speeches in The Hague on the 25th, expounding his position on hot issues such as the EU budget, defense expenditure and the situation in Russia and Ukraine. ⑵ Regarding the EU's defense budget, Orban said: "If the EU budget is recalculated, defense expenditure can reach 5%. This statement has aroused concern about the future direction of the EU's defense policy. ⑶ In response to the main challenges facing Europe, Orban clearly pointed out: "The biggest threat facing Europe is the loss of economy and xmmarkets.cnpetitiveness." This view directly points to the core issues of the current development of the EU. ⑷On the issue of Russia and Ukraine, Orban made a remark: "Russia is not enough to pose a real threat to us, we are much stronger than Russia." This statement is in sharp contrast to the mainstream EU position. ⑸ Regarding NATO's relations with Ukraine, Orban emphasized: "NATO has nothing to do with Ukraine."

The Bank of Thailand remained silent

⑴ The Bank of Thailand maintained the benchmark interest rate as scheduled on Wednesday, and the trend of Thai stocks and the Thai baht was stable. ⑵The Bank of Thailand maintains the one-day repurchase rate at 1.75%, and has cut interest rates twice in a row. The bank said monetary policy remains loose to support the economy and is ready to adjust interest rates if necessary. The exchange rate of Thai baht against the US dollar was 32.623, basically the same. ⑶OCBC said: "The statement of the Central Bank of Thailand is still dovish, suggesting further easing may be further relaxed in the next few months. We expect another 25 basis points to cut interest rates in the second half of 2025, as domestic political uncertainty and US tariff risks put economic growth under downward pressure." ⑷ Thailand's political uncertainty continues. After withdrawing from the ruling coalition, the Thai Pride Party announced that it would file a motion of distrust against Prime Minister Seita Ta's reputation and his cabinet, which puts the already difficult government under greater pressure.

The Swedish central bank suggests further interest rate cuts this year but emphasizes high uncertainty in the policy path

⑴ The meeting minutes released by the Swedish central bank on Wednesday showed that if the economy is weak and inflation remains moderate, the bank may cut interest rates again before the end of the year. Last week it had lowered its benchmark interest rate from 2.25% to 2.00%. ⑵ Swedish Central Bank Governor Erik Thedeen said: "We have sent out a signal of the possibility of further interest rate cuts, but given the high uncertainty of the current environment, this signal should not be over-interpreted." ⑶ Economic data show that Sweden's GDP shrank by 0.2% month-on-month in the first quarter, and the government lowered its full-year economic growth forecast for 2025 to 0.9% this week. Meanwhile, inflationary pressures continue to ease, but the central bank warns that geopolitical conflicts may disrupt the trend. ⑷ Meeting minutes pointed out that if tensions between Israel and Iran escalate, it may push up oil prices and lead to a rebound in inflation. In addition, the risks of trade frictions have not been eliminated, which may force monetary policy to face a dilemma. ⑸ The Swedish Central Bank emphasized that inflation may deviate from the current forecast in the future, and the risks of upward or downward coexist. Next interest rateThe resolution will be announced on August 20.

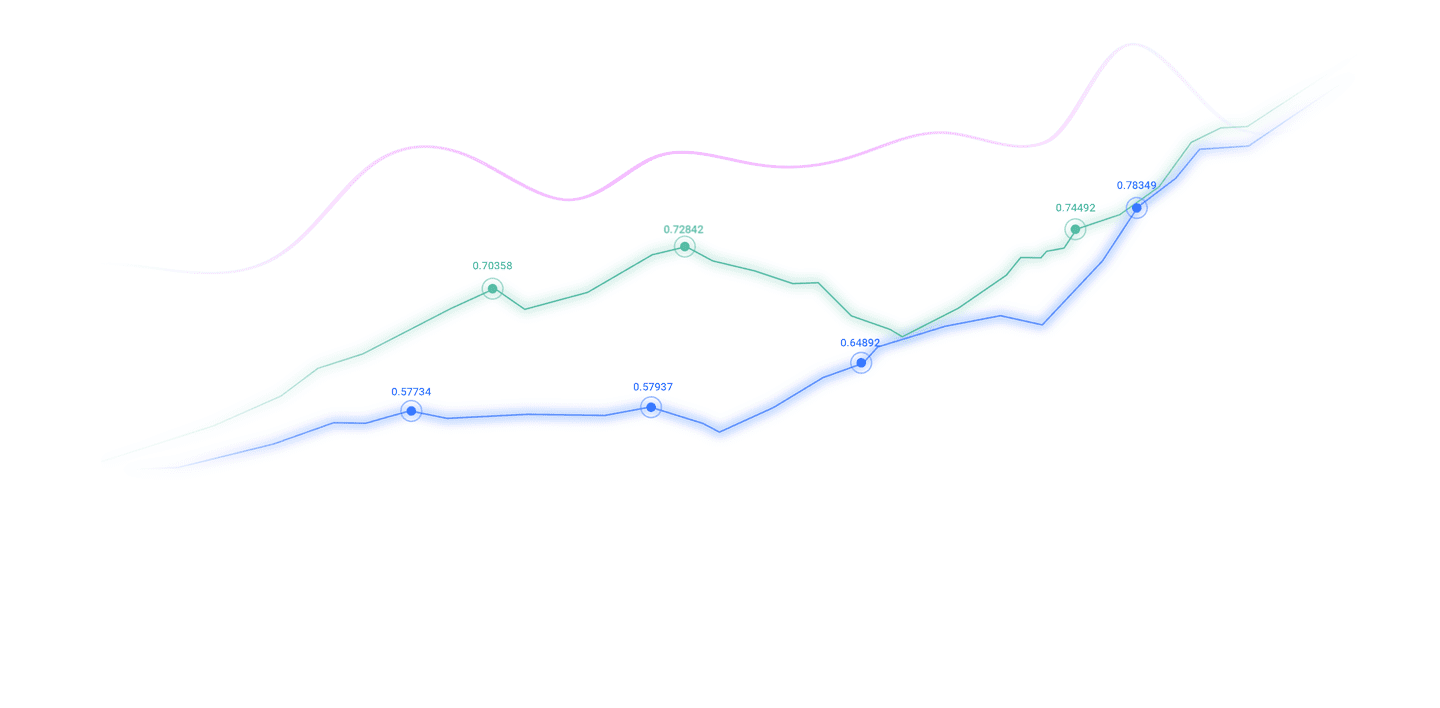

3. Trends of major currency pairs in the New York Stock Exchange before the market

Euro/USD: As of 20:23 Beijing time, the euro/USD fell and is now at 1.1602, a drop of 0.07%. Before New York City, the price of (Euro-USD) attempted to gain positive momentum in its recent intraday trading, which could help it recover and rise again and successfully unload its overbought status on (RSI), which despite these temporary declines, remained stable above the key resistance of 1.1600, confirming that in the case of a predominant short-term major bullish trend, it technically broke through that resistance and its trading was on a slash.

GBP/USD: As of 20:23 Beijing time, GBP/USD fell and is now at 1.3603, a drop of 0.09%. Before the New York Stock Exchange, (GBPUSD) price rose on the last trading day after reaching our target yesterday at the key resistance of 1.3630, which rebounded lower due to the stability of the resistance, attempting to gain a bullish momentum that could help break through that resistance, successfully unloading some obvious overbought conditions on (RSI), strengthening its bullish track as short-term bullish trends dominate and trading along a slash.

Spot gold: As of 20:23 Beijing time, spot gold rose, now at 3327.37, an increase of 0.13%. Before the New York market, the price of (gold) fell in the last intraday trading, dominating the short-term bearish correction trend and trading along the bias line, this decline was after recovering some of the previous losses, bringing the (RSI) indicators into overbought levels through a series of cautious gains, indicating that it began to produce a negative divergence from them, exacerbating the negative pressure around the price as negative overlap signals emerged.

Spot silver: As of 20:23 Beijing time, spot silver fell, now at 35.777, a drop of 0.30%. Before the New York Stock Exchange, the price of (silver) fell in recent intraday trading, affected by the stability of the main resistance level at $36.00, and dominated the short-term bearish correction trend, and its trading was traded along the bias line, with negative pressure caused by its trading below EMA50, and (RSI) began to show negative overlap signals after reaching overbought levels.

Crude oil market: As of 20:23 Beijing time, U.S. oil rose, now at 64.570, an increase of 0.31%. Before the New York Stock Exchange, the (crude oil) price fell in the most recent trading day after recovering its previous losses in today's early trading. In today's early trading, it took advantage of the support of the short-term major bullish trend line, gained some positive momentum of rebounding and successfully got rid of the obvious oversold conditions of (RSI) to reach an overbought level xmmarkets.cnpared to the price trend, opening the way to record future losses.

4. Institutional View

Morgan Stanley: The Federal Reserve is expected to cut interest rates seven times in 2026. Starting from March, the final interest rate will drop to 2.5% to 2.75%

Morgan Stanley expects that the Federal Reserve will cut interest rates seven times in 2026. Starting from March 2026, the final interest rate will drop to 2.5% to 2.75%. The Federal Reserve's federal funds rate is currently 4.25%-4.5%, and the final interest rate of Morgan Stanley is expected to be 175 basis points higher (25 basis points * 7). According to the Fed's dot chart in June, the Fed expects two interest rate cuts in 2025, while Morgan Stanley expects no interest rate cuts in 2025; the Fed expects one interest rate cut in 2026, and Morgan Stanley expects seven interest rate cuts in 2026.

Institution: The Fed may not cut interest rates until December

The US dollar rose slightly after Fed Chairman Powell maintained a cautious stance on the issue of interest rate cuts. Powell testified in Congress on Tuesday that he seemed to pour cold water on the prospect of a rate cut in July, rejecting President Trump's call for a lower interest rate. Pepperstone strategist Michael Brown said in a note that the Fed may not cut interest rates until December, and will only cut interest rates by 25 basis points this year.

The above content is all about "【XM Group】: Powell stays patient, analyzes the short-term trend of spot gold, silver, crude oil and foreign exchange on June 25". It is carefully xmmarkets.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here