Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--USD/JPY Forecast: USD Swings Wildly Against Yen After Jobs Data

- 【XM Forex】--AUD/USD Forex Signal: Aussie Retreats Below Key Support Level

- 【XM Forex】--USD/TRY Forecast: Reports Reveal Lira's Significant Appreciation in

- 【XM Decision Analysis】--WTI Crude Oil Weekly Forecast: Range Steady as Holiday S

- 【XM Decision Analysis】--USD/TRY Forecast: Lira Stabilization Expected After Trea

market analysis

Whether the gold 3200 double bottom threshold can be stabilized, the cpi is the key tonight

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Whether the gold 3200 double bottom threshold can stabilize, CPI is the key tonight." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Whether the gold 3200 double bottom threshold can stabilize, CPI is the key tonight

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday's plunge sharply lower than US$40. The original plan was to fill the gap first when it was high at 3320 and then suppress the bearish decline. It also happened to be the upper rail pressure point of the short-term decline channel, and it is easy to continue when it opens low in the morning. Therefore, try to look at the rebound in the short-term to fill the gap, but after running for a certain period of time, it is found that the middle rail has fallen again in 15 minutes, so it is conservative to adjust its position in advance; the European market ushered in a big negative dive, perfectly avoiding risks; since the high gap resistance does not give the expected bearish position, the European market fell and weakened again, for the US market, it is to plan in advance Bearish, 618 resistance is 3258, which is also the top-bottom conversion position, touching the bearish position, but still gives no chance; however, the US uses 3200 as the key defense before the session, relying on the lower track of the short-term decline channel to support 3220 on the 320 line, and watch a wave of rebound when it is low, and finally successfully reaches the 3250 line;

Second, silver: In recent days, the resistance is 33 down and the support is 3220, yesterday's trend is more perfect in line with the sweeping operation in this range;

Third, crude oil: Yesterday, the Asian and European sessions rose continuously, and the US market originally planned to fall back to 62.4 to follow the bullish, but it ran until the evening, after the price hit, it returned to the channel and did not hold the upper track, so it gave up the layout;

Interpretation of today's market analysis:

Part 11. Gold daily line level: Yesterday closed at a big negative, the closing price slightly pierced the lower track of the upper chart channel. It is temporarily held, and today is more critical; if it can close a good positive K, it may be able to keep this channel and continue to operate, then the 3200 line is expected to become a short-term double bottom, and the market will rise upward in the future to test the yellow trend resistance line; on the contrary, if it continues to close today and effectively loses the lower track of this channel, it will continue to lower and correct in the short term, and gradually move towards the 66-day moving average. Go up and seek stability;

Second, gold 4-hour level: At this time, the short term is expected to be a golden cross on the 10th, and above 3240 will become a certain support performance. The key strong support or the annual average will move upward by 3200 line; one of the resistance is the high point of the big negative in front of 3283, which is also the split pressure, the strong pressure is the middle rail 3293, or close to the 3300 mark; pay attention to the gains and losses of the operation between support and resistance;

Third, golden hourly line level: There was a sharp drop at 10 o'clock today, but it still stabilized at the 3200 mark, not losing the overnight low point. After the bottoming out, the continuous positive rebound stood on the middle track, and it was believed that there was a wave of pull-up in the afternoon, and it really rushed to the current high of 3265; then at this time, 3240-47 became a certain top-bottom support, the middle track supported 3240, and the yellow trend line support moved up 3222. As the low point gradually moved up, the high point gradually rose. The trend at this time is after a big drop. Rebound correction; the upper rail of the key channel is under pressure below 3270. If this position cannot break through the station, then it will be still a downward channel or weak in the short term, and it will be easy to further suppress; on the contrary, if you break through the upward channel and walk out of the downward channel, you will be expected to turn into an upward channel and further rise and strengthen, and will test the annual moving average of 3300 mark; in the end, only by standing firm in the 3300 annual moving average can you xmmarkets.cnpletely end the decline and correct it and return to the trend to rise; therefore, it still needs a process, and you still need to pay attention to the news of Sino-US trade in the middle. Interference, tonight's CPI inflation data may be a fuse to guide gold to further weaken and fall, or end its weakness and gradually become stronger; if the announced value is greater than expected, inflation will rise, weaken the expectation of interest rate cuts, which will be bad for gold prices; on the contrary, if the announced value is less than expected, inflation will weaken, increasing the expectation of interest rate cuts, which will be bullish for gold prices; however, one thing to note is that if inflation is announced, but the expectation of interest rate cuts has not weakened the change, gold has an anti-inflation and preservation effect, which will be bullish for gold prices;

In short, pay attention to 3 tonight 240-47, 3222 support stabilizes, take 3200 as the turning point of the Feng Shui Mountain, and hold it to continue to maintain the bottom oscillation or gradually rebound; once it breaks through to stand above 3270, the rebound will strengthen, and test the 3300 mark; and then breaks through to stand above 3300 and stands firm, the downward adjustment will end and return to the trend to rise; then as long as 3270-3300 still cannot be suppressed in the middle, it will continue to rise and fall repeatedly to test the bottom support; if it accidentally falls below 3200, it will point to 3160-3150. It’s better to be mentally prepared first, and hope it won’t happen;

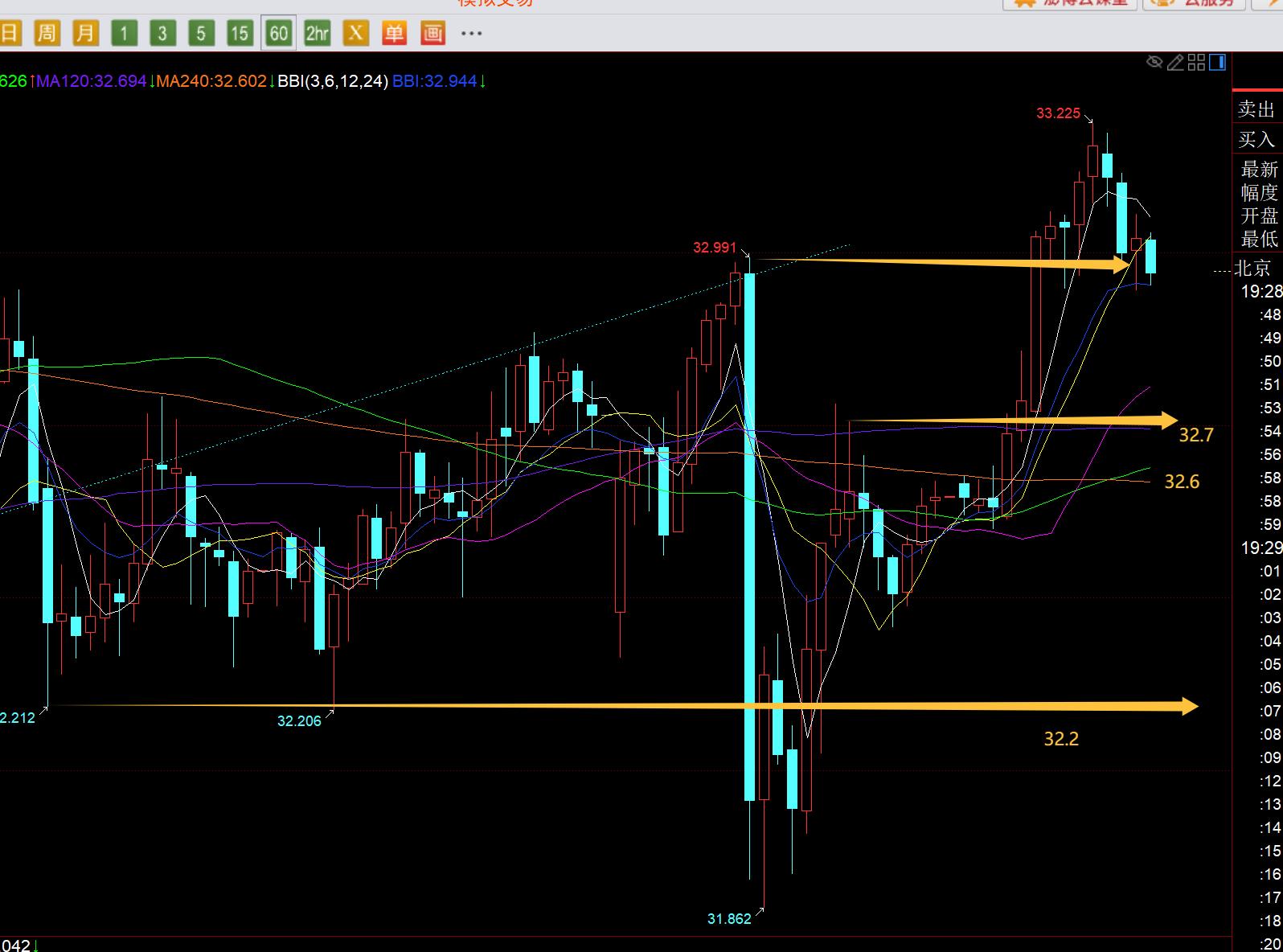

Silver: The silver increase in the past two days is significantly greater than that of gold, which is relatively resistant to declines. It broke through the 33 yesterday’s high during the day, and continued to fluctuate and bullish in the short term. Tonight, it will focus on the bullish above 32.6-32.7, and there will be top and bottom support on 32.9, with resistance of 33.25, 33.5, 33.65;

Crude oil: Yesterday, a long upper shadow K closed, with certain resistance below 63.5. This morning, it was originally planned to fall back to 61 and fluctuate and look forward to a bullish wave, but it does not give you a chance; pay attention to 63-63.5 tonight, if you cannot bear pressure, consider looking at the pressure and decline;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and the interpretation of text and videos. Friends who want to learn can xmmarkets.cnbine the actual trend. For xmmarkets.cnparison and reference; those who recognize ideas can refer to operations, lead defense well, risk control first; those who do not recognize them should just be over; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, and serve the wholeheartedly, with sincerity, sincerity, perseverance and wholeheartedly! xmmarkets.cnments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Market Analysis]: Whether the double bottom threshold of gold 3200 can be stabilized, cpi is the key tonight" is carefully xmmarkets.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here