Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--Gold Analysis: Upward Trend to Continue Amid Significant E

- 【XM Forex】--ETH/USD Forecast: Ethereum Awaits Momentum

- 【XM Market Analysis】--USD/MYR Forex Signal: Poised for Breakout

- 【XM Forex】--Weekly Forex Forecast – Bitcoin, AUD/USD, EUR/USD, NASDAQ 100 Index,

- 【XM Group】--Gold Forecast: Gold Returns with a Vengeance

market news

Civil strife in the United States is imminent, and gold and silver bulls are at a critical juncture

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: The United States is in trouble, and long positions in gold and silver are at the gate." Hope it will be helpful to you! The original content is as follows:

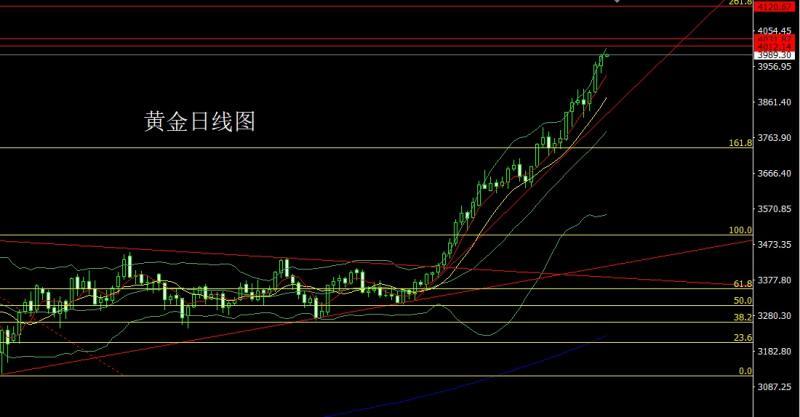

Yesterday, the gold market continued to pull up. After opening at 3960.2 in the morning, the market first rose and gave the position of 3977.5, and then the market surged and fell. The daily line was at the lowest point of 3940.7 and then the market rose rapidly. The daily line reached the highest point of 3991.3 and then the market consolidated. The daily line finally closed at 3984.6, and then the market closed with a medium-positive line with a long lower shadow line. This pattern ended. After that, today's market situation will inevitably impact the 4000 integer mark. At the point, the long 3325 and 3322 below are the long and the long 3368-3370 last week, and the long 3377 and 3385 long and 3563 long and 3563 long and then the stop loss is followed at 3650. If today's market falls back first, the stop loss is 3965 long and 3959, the target is 3992 and 4000, and if the break is broken, the pressure is 4012 and 4023 and 4032 above to try to make short profits and settle short positions.

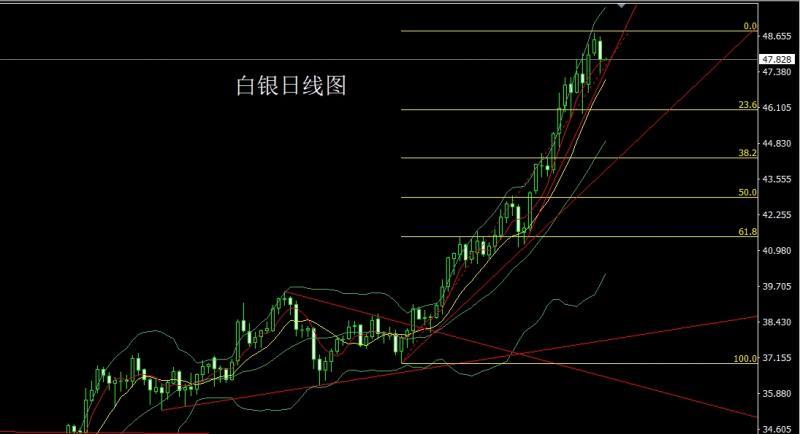

The silver market opened at 48.484 yesterday and the market rose slightly. The market fluctuated strongly. The daily line was at the lowest point of 47.296 and the market consolidated. The daily line finally closed at 47.813. Then the market closed with a large negative line with a long lower shadow line. After this pattern ended, the long position of 37.8 and the long position of 38.8 below were reduced and the stop loss followed up at 44. 44.6's long position reduction and stop lossFollow up and hold at 45. Today's 47.5 long stop loss and 47.3 target look at 48, 48.3 and 48.6 pressure. If the position is broken, look at 48.8 and 49-49.5 historical high pressure.

Yesterday, the European and American markets opened at 1.17091 in early trading, and then the market rose slightly to reach 1.17150, and then fell back strongly. The daily line reached the lowest position of 1.16461, and then the market consolidated. The daily line finally closed at 1.16561. The daily line closes with a big negative line with a lower shadow line that is slightly longer than the upper shadow line. After the end of this form, the short stop loss below 1.17100 today is 1.16600 and 1.16400, and below it is 1.16200 and 1.16000.

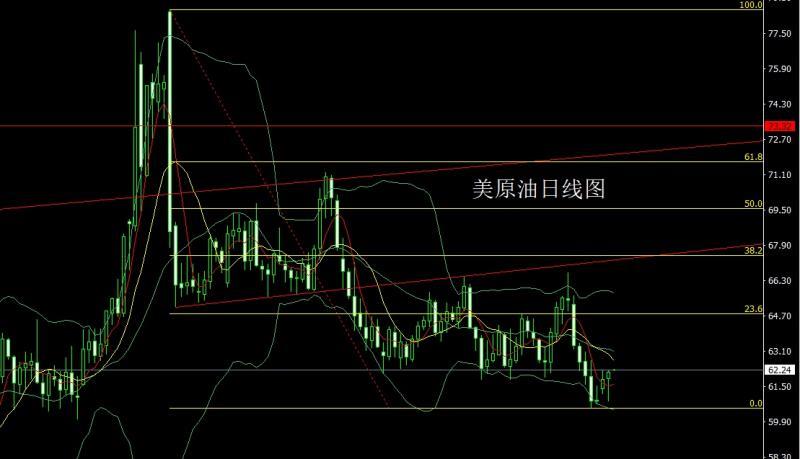

The U.S. crude oil market opened at 61.84 yesterday and then the market first rose to 62.16 and then quickly fell back. The daily low reached 60.81 and then the market rose strongly. The daily high hit 62.23 and then the market consolidated. The daily line finally closed at 62.14. After reaching the position, the daily line closed in the form of a hammer with a very long lower shadow. After this form ended, today's market went back to bullish positions. Yesterday's long position reduction of 61.3 was followed by a stop loss of 61, and today's long position of 61.6 was stopped at 61. The target is 62.2, 62.6 and 63-63.3.

After the Nasdaq opened at 24977.71 yesterday, the market first fell back to 24911.97 and then quickly rose. The daily high hit the 25067.57 position, and then the market fell strongly during the US session. The daily low reached the 24775 position and then consolidated. The daily line finally closed at 24853.9. The next day's line closes with a barcode line with an upper shadow line slightly longer than the lower shadow line. After the end of this form, today's 25035 short stop loss target below 25090 is 24850 and 24750, and if it falls below 24600 and 24550.

Fundamentals, yesterday's fundamentals, the US New York Fed's 1-year inflation forecast in September was 3.38%, the previous value was 3.20%. The risk of civil unrest in the United States is currently increasing after the U.S. government shutdown. Due to the shortage of air traffic control personnel caused by the U.S. government shutdown, the U.S. Federal Aviation Administration (FAA) issued a notice that evening saying that flights in major cities such as Chicago, Dallas and Nashville were experiencing widespread delays. At the urging of the President of the United States, members of the Texas National Guard have now arrived near Chicago. Some soldiers have gathered outside ChicagoA military facility is expected to be operated in the city immediately. But they will continue to receive crowd control and legal training until any specific tasks are performed. Sources said that the first batch of soldiers deployed were about 200, and more Texas soldiers may join in the future. After convening global generals to return to the United States for a meeting and saying that the military should obey the Republican Party, the sending of another major Democratic voter has further brought the possibility of bipartisan confrontation and conflict. Therefore, it was natural for the gold market to continue to hit the 4,000 mark yesterday under multiple risk aversion. Today's fundamentals mainly focus on the EIA crude oil inventories from the United States to October 3, and the EIA crude oil inventories from the United States to October 3, the EIA crude oil inventories from the United States to October 3, and the EIA strategic oil reserve inventories from the United States to October 3. Tomorrow morning, the Federal Reserve will release the minutes of the monetary policy meeting at 2:00.

In terms of operation, gold: 3325 and 3322 long below and 3370 long last week, 3377 and 3385 long and 3563 long last week, and the stop loss followed up at 3650. If the market falls back first, the 3965 long and 3959 stop loss, the target is 3992 and 4000. If the break is made, look at 4012 and 4023 and 4032 pressure above to try to make short profits.

Silver: The long position of 37.8 and the long position of 38.8 below will be reduced and the stop loss will follow up at 44. The stop loss is followed by the 44.6 long stop loss after reducing positions, and today's 47.5 long stop loss is 47.3 target, 48 and 48.3 and 48.6 pressure, if the position breaks, the pressure of 48.8 and 49-49.5 historical highs.

Europe and the United States: Today's 1.16950 short stop loss 1.17100 targets below 1.16600 and 1.16400, and below 1.16200 and 1.16000.

U.S. crude oil: yesterday's 61.3 long stop loss followed at 61, today's 61.6 long stop loss 61, and the target is 62.2 and 62.6 and 63-63.3. /p>

Nasdaq Index: Today, the target below 25035 short stop loss 25090 is 24850 and 24750, and the target below 24600 and 24550 is 24600 and 24550.

The above content is all about "[XM Foreign Exchange Market Review]: The United States is in trouble, and gold and silver long orders are on the verge of the threshold". It is carefully xmmarkets.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here