Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--USD/CAD Forecast: Stagnates Amid Uncertainty

- 【XM Decision Analysis】--USD/JPY Forecast: Finding Buyers on Dips

- 【XM Decision Analysis】--USD/CAD Forecast: Canadian Dollar Continues to Fall Apar

- 【XM Group】--USD/JPY Forecast: Nears Breakout

- 【XM Forex】--Gold Analysis: Gold Hits Record Highs Amid Tariff Uncertainty

market analysis

Gold hit a second low of 3311 and continued to fluctuate and rise

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: After gold hits its second low of 3311, it will continue to fluctuate and rise." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold hit the second low of 3311 and continued to fluctuate and rise

Review yesterday's market trend and technical points:

First, gold: Yesterday's morning, it continued to rise continuously, closed at 10 points, closing above the European and US market resistance level 3328-3332 on the night before. Therefore, the afternoon retracement attempts to continue bullish, but the operation is a few After an hour, the cost loss protection will be moved upward; the European market is unable to rise, and the US falls before the market, and the US falls back after the market, and the US moves back to the 3311 line to stabilize. This position is the 618 split position in the day 3295-3337 intraday, which is also the second low point obtained by the research report analysis. After the final stable out of the hourly line, it is recommended that 3323 continue to follow the bullish and successfully rise today;

Second, silver side Surface: Yesterday, relying on the daily middle track above 35.45, it continued to be bullish, but unfortunately it only touched 35.65, which finally met the pull-up impact above 36;

Third, crude oil: yesterday's narrow bottom was sorted, and there was no operational value;

Today's market analysis and interpretation:

First, gold daily line level: yesterday closed at a small positive, the low point began to move upward, and 3311 may become the second low point, because today's upward breakthrough Yesterday's high point was just not stable for the time being; therefore, formally speaking, we need to check today's closing price to confirm. The middle rail resistance is 3350. If the closing position is above this point, 3311 will basically become the second low point. Upward can gradually test 3370 and 3380, which are the 10 moving average and the channel lower rail counterpressure point; and if 3295 becomes the short-term bottom, 3311's second low point cannot be lost;

Second, golden hourly line level: From the above chart, it is currently running on the upward channel and oscillating rebound, and it is temporarily weak below 3370. It is necessary to keep this oscillation slow upward and continue, and then break through its upper rail and exert force to xmmarkets.cnpletely turn from weak to strong; today it will fluctuate and rise first, just reaching the short-term target resistance level of the 3350 line, and then rise to the 3350 line at the short-term target resistance level. At this time, it will rise and fall. Pay attention to the lower rail 3326-27 line. In addition, the 3333 line is the middle rail. Tonight, we will pay attention to whether the support can be stable, and then oscillate and pull up again to test the upper rail; short-term resistance is 3354-58, which is the reverse pressure of the channel in the figure, and it is also the 618 division resistance of 3393-3295;

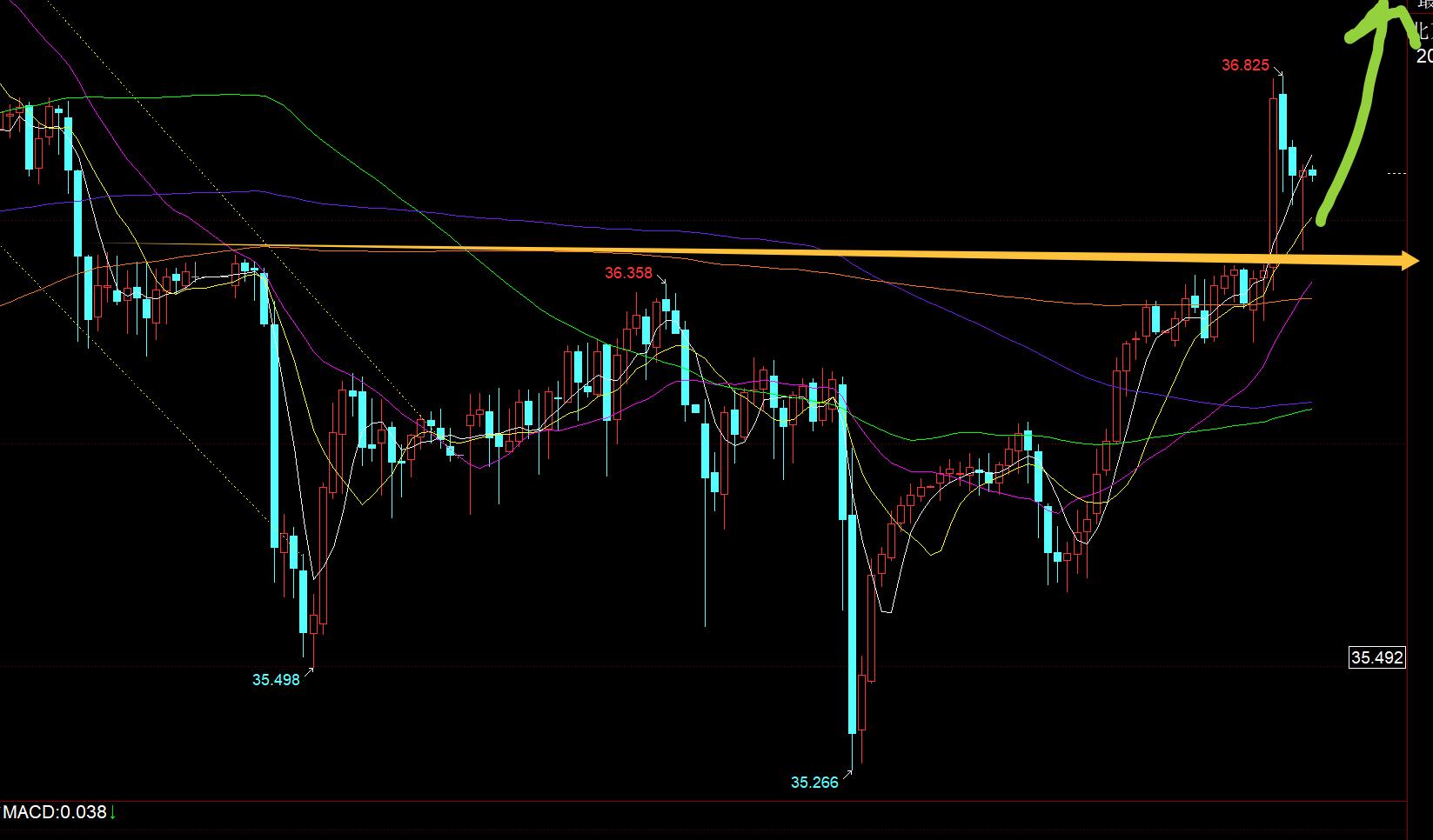

Silver: Its trend is very clear. The big European market positive effectively breaks through the 36.4 sideways resistance level. Tonight, it will become the top and bottom support. It is only necessary to continue to be bullish when it is low. The resistance target is 36.8. The breakthrough is at the previous high of 37.3. The gains and losses of the first line;

Crude oil: the crude oil amplitude has been very small in the past two days, the bottom is converged triangle, and the end is running, and it may break through at any time; pay attention to the effective breaking of the two yellow lines in the figure. Due to the bottom divergence of the short-term macd, it tends to launch an oversold rebound correction upward, and then use the daily channel reverse pressure point 71 to rise and fall; Therefore, the low point within 64.5 days is used as a feng shui hurdle, and look at the rebound first at 65 and up;

The above are several points of the author's technical analysis, as reference, and it is also the summary of technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and the interpretation of text and videos. Friends who want to learn can xmmarkets.cnpare and refer to it based on the actual trend; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not recognize them should just float by; Thank you for your support and attention;

【The views of the article are for reference only, investment is risky, and you need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng Dianyin

After reading the market for more than 12 hours a day, persisting for ten years, detailed technical interpretation is made public on the entire network, and serve the wholeheartedly, with sincerity, sincerity, perseverance and wholeheartedly! xmmarkets.cnments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, division rules, and top-bottom rules; Student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Platform]: Gold continues to fluctuate and rise after stable lows of 3311", which is carefully organized by the XM Foreign Exchange editorEdited, I hope it will be helpful to your transaction! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here