Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--EUR/USD Forecast: Plummets Below Major Support

- 【XM Forex】--Silver Forecast: Silver Limps into the New Year

- 【XM Market Review】--GBP/USD Analysis: Technical Indicators Head for Oversold

- 【XM Forex】--ETH/USD Forecast: Ethereum Continues to Wait Patiently

- 【XM Forex】--EUR/USD Analysis: Bearish Dominance May Strengthen

market news

Economic data support the dollar's rebound, investment banks say weak non-structural reversal

Wonderful Introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will always remember. Be a strong person. Let "strong" set sail for me and always accompany me to the other side of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Economic data supports the rebound of the US dollar, and investment banks say that weak non-structural will reverse." Hope it will be helpful to you! The original content is as follows:

Asian Handicap Market Review

On Thursday, the US dollar index fell below 97 during the session, and as of now, gold is priced at 97.37.

Geo-conflict: ①Iran’s Foreign Minister: At present, Iran has no plan to restart nuclear negotiations. ③Iranian Supreme Leader Khamenei appeared for the first time after the ceasefire, saying that the US attack on nuclear facilities had "little results" and Trump was making a show. ④CNN: The United States plans to discuss easing sanctions on Iran to return to nuclear negotiations.

Federal Official News:

①Balkin: Possible neutral interest rates are estimated to rise slowly over time; tariffs will begin to push up inflation. ②Gulsby: If inflation remains within the 2% range and uncertainty is resolved, the Federal Reserve will take the path of interest rate cuts; Trump announced in advance that Powell's successor will not have any impact on the FOMC. ③Daly: The fall rate cut looks promising. ④ Collins: It may be too early to cut interest rates in July.

Tariff policy development:

①Indian officials: India and the United States trade negotiations are at a deadlock. The United States said it was about to reach an agreement with it. ②Foreign media: The EU is considering reducing tariffs on US imports in order to reach a trade agreement with the US quickly. ③White House: There is no plan to extend the July 9 tariff suspension period, and the change will be decided by the president.

④LuthneyK: Being optimistic about reaching a trade deal with the EU, multiple agreements will be announced around next week. ⑤ Von der Leyen said he was ready to reach an agreement with the United States and prepare for the possibility of an agreement with him. Macron said the best US-European agreement is 0 tariffs to 0 tariffs.

U.S. Treasury Secretary Bescent asked Congress to remove the "899 retaliation tax clause."

The EU summit has not reached an agreement on a new round of sanctions against Russia, and the EU has agreed to extend the existing sanctions against Russia for six months.

The U.S. xmmarkets.cnmodity trade deficit unexpectedly expanded in May, with exports hitting the largest drop since the epidemic; GDP data in the first quarter was revised down.

White House: Trump will not make a decision on the candidate for the next Federal Reserve Chairman in the near future.

Summary of institutional views

xmmarkets.cnericaBank chief economist Bill Adams: The Federal Reserve's momentum for interest rate cuts is not a weakness in the job market

Although the latest GDP data shows that the employment market has deteriorated, the employment aspect of the Fed's dual-task is unlikely to be the driving force for interest rate cuts this year. The U.S. economy is entering the second half of 2025 on an unstable basis. Real GDP contraction in the first quarter exceeded expectations, and most of the monthly economic data in May showed a low-quality rebound in GDP in the second quarter. Real GDP in the second quarter will be less dragged down by the trade deficit, but more cautious spending by consumers and some businesses will partially offset the impact.

The trade deficit further widened in May, while retail sales, industrial production, new home starts and new home sales all fell this month. Labor demand continues to be weak, and despite relatively low initial jobless claims, the number of unemployment continues to climb to its highest level since the end of 2021. Most industries have relatively low layoff rates, but the number of recruitment is weak. Unemployed employees, fresh graduates and those who re-enter the labor market after a break are harder to find jobs than they were a few years ago.

But weak labor market data may not translate into an increase in unemployment, as the Trump administration's immigration policy could lead to a sharp slowdown in labor growth in 2025. If job growth and labor growth slow down simultaneously, the unemployment rate may remain stable or even decline. This means that the declining GDP—including its weaker job xmmarkets.cnponents—is unlikely to have a significant impact on the Fed’s monetary policy calculations.

xmmarkets.cnbined with the recent performance of various data, the Fed is more likely to cut interest rates because inflation is better than expected, rather than because the unemployment rate is worse than expected.

Dutch International Bank: The German economy is “dually in the world”, corporate confidence is high, but consumers are bleak!

The confidence of German xmmarkets.cnpanies has continued to rise since the beginning of this year, and the market's optimism about the new government driving economic growth has increased, but consumers are still skeptical. The latest German GfK consumer confidence index fell to -20.3 in June, down from last month's -20.0.

Since this year, German consumers' confidence has changedThe goodness is weak. While consumers also feel growing business optimism, concerns about inflation and higher tendencies to save are curbing their confidence. Data shows that although private consumption performed unexpectedly better than expected in the first quarter, from a macro perspective, private consumption has not yet fully recovered from the energy price shock in 2022. In fact, deterioration in the labor market and increased geopolitical uncertainty are still plaguing German consumers.

Looking forward, while the new government's investment plan boosted recent business optimism, it has not yet ignited consumer enthusiasm. So far, the government's fiscal stimulus package has been almost entirely targeted at businesses, not households. Therefore, the German economy needs a positive change in the labor market and a significant increase in purchasing power before private consumption can achieve substantial growth again.

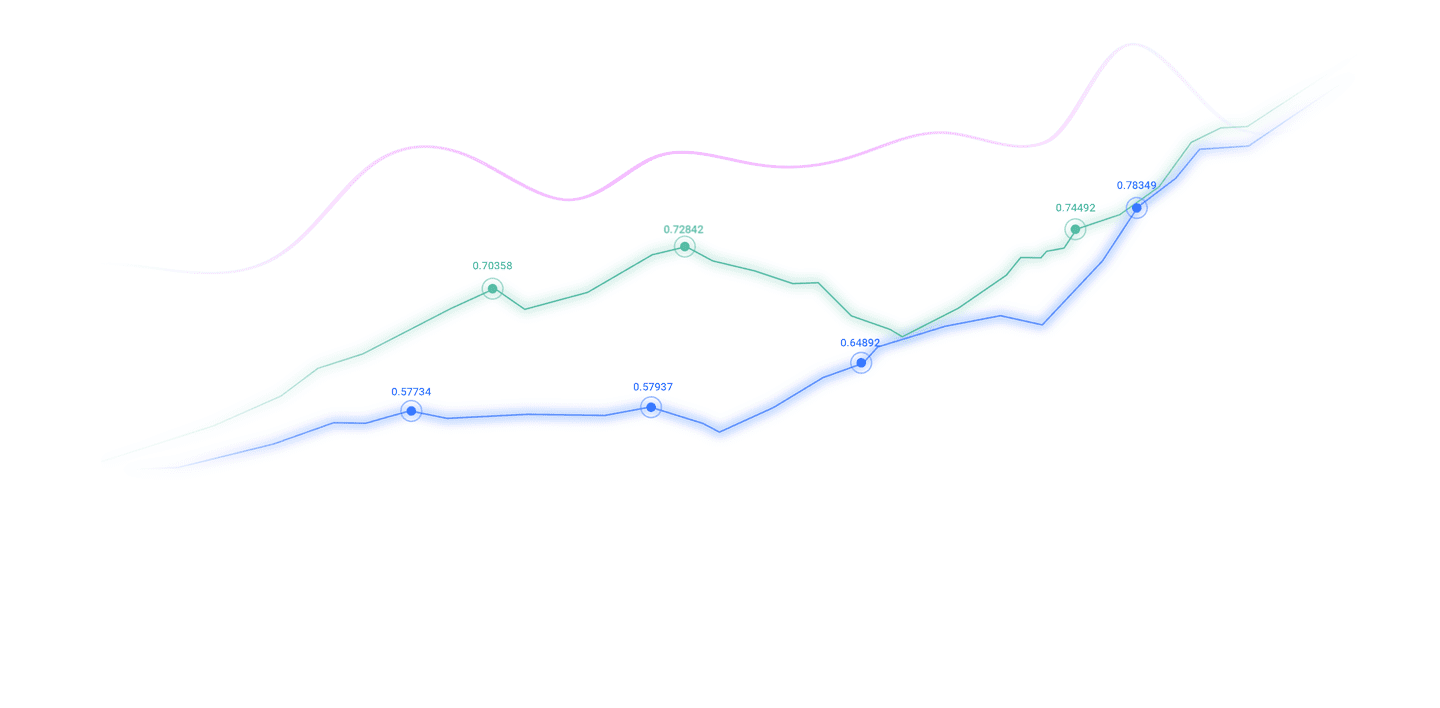

Citigroup: The medium-term bearish dollar, but not structural

Uncertainty turns to hard data. Before we reach a clearer conclusion (which may still take several months), we are more likely to be in a volatile Forex market, but the dollar sell-off will be asymmetric. We expect the Fed to reprice dovish once the second half of 2025 data turns to put pressure on the dollar. Fiscal risks have been reduced in the short term, but this year will remain another resistance the dollar faces.

However, the dollar weakness will be cyclical rather than structural. Once a policy xmmarkets.cnbination that is more conducive to growth is realized, the weak trend of the US dollar will reverse next year. So far this year, negative US dollar flows are driven more by adjustments to foreign exchange hedging ratios than actual asset rotations. The increase in EU fiscal spending is positive but has also been priced, and investors may overestimate its long-term impact on potential EU GDP growth.

Although we remain skeptical, we believe that the dollar's reserve currency status will remain. While policy uncertainty has led to weakening of the dollar, we do not expect reserve managers to sell their dollar assets given limited other options.

Wells Fargo: The "surge" of durable goods orders in May may be short-lived, and the US economy is expected to be...

Data from the US Department of xmmarkets.cnmerce show that durable goods orders surged by 16.4% month-on-month in May, which is the largest single-month increase since 2014. Similar to 2014, this growth was mainly driven by an explosive growth of 230.8% for civil aircraft orders. Looking back on history, after orders for durable goods increased by 26.4% in July 2014, they plummeted by 21.2% the following month, and continued to decline for the rest of the year. Although we cannot conclude that the same mistake will repeat the rest of the year, there is a high possibility that orders will fall next month, and we predict that capital investment will enter a period of weakness in the second half of the year.

In addition to durable goods data, other data released tonight also confirm this theme. U.S. GDP growth was lowered in the first quarter, mainly due to weak service consumption, which indicates a weakening momentum for consumer spending. In addition, the number of people who continue to apply for unemployment benefits is on the rise.

Preliminary dataIt shows that exports shrank sharply in May and imports stagnated, which shows that the US xmmarkets.cnmodity trade deficit has widened and net exports may not be as effective as we had previously expected. Overall, the U.S. economic growth momentum is weakening in the first half of this year.

The above content is all about "[XM Foreign Exchange Market Review]: Economic data supports the rebound of the US dollar, and investment banks say that weakness and non-structural reversal" is carefully xmmarkets.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here