Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--GBP/USD Analysis: Holds Neutral, Eyes Key Resistance

- 【XM Decision Analysis】--BTC/USD Forecast: Finds Support Again

- 【XM Decision Analysis】--NZD/USD Analysis: After Nervous Sentiment Test Upwards M

- 【XM Forex】--USD/JPY Forecast: Tests Key Support

- 【XM Decision Analysis】--USD/JPY Forecast: US Dollar Falls Against Japanese Yen o

market analysis

The pregnancy line is hidden in the abyss, and gold and silver step back low

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The pregnant line is hidden in the abyss, and gold and silver are back to the low long". Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market consolidated in the range. The market first rose after the opening at 3324.3 in the morning. The daily line has reached the 3337.6 position and the market quickly fell. The daily line was at the lowest level of 3311.3 position and the market rose at the end of the trading session. The daily line finally closed at 3332.1 position. The market closed with a long lower shadow line. After this pattern ended, today's market had a certain technical rebound demand. At the point, today's 3327 is conservative and 3325 is more stop loss 3321, and the target is 3342 and 3345 and 3352 and 3356 pressure.

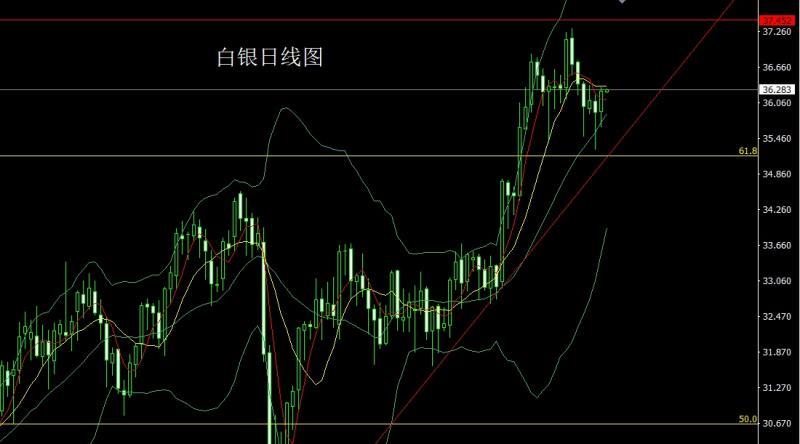

The silver market opened at 35.91 yesterday and the market first fell. The sun was at the lowest point and the lowest point was at 35.643. The market rose strongly. The daily line reached the highest point at 36.315 and then the market consolidated. The daily line finally closed at 36.255 and then the market closed with a large positive line with a long lower shadow line. After this pattern ended, the 36-long stop loss was 35.8 today, and the target was 36.35 and 36.6 and 36.8.

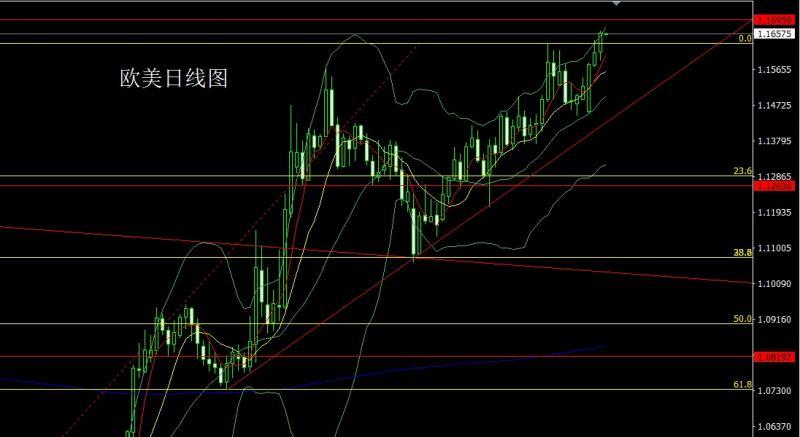

European and American markets opened at 1.16099 yesterday and the market rose first and gave the position of 1.16319 and then fell rapidly, with the lowest daily line.After giving the position of 1.15890, the market rose strongly by the fundamental shadow line during the trading session. The daily line reached the highest point of 1.16648 and the market consolidated. The daily line finally closed at the position of 1.16593 and then closed with a large positive line with a long lower shadow line. After this pattern ended, it fell back to a long day. At the point, it was more than 1.16300 and 1.16100 today. The target was 1.16650 and 1.16850 and 1.17000.

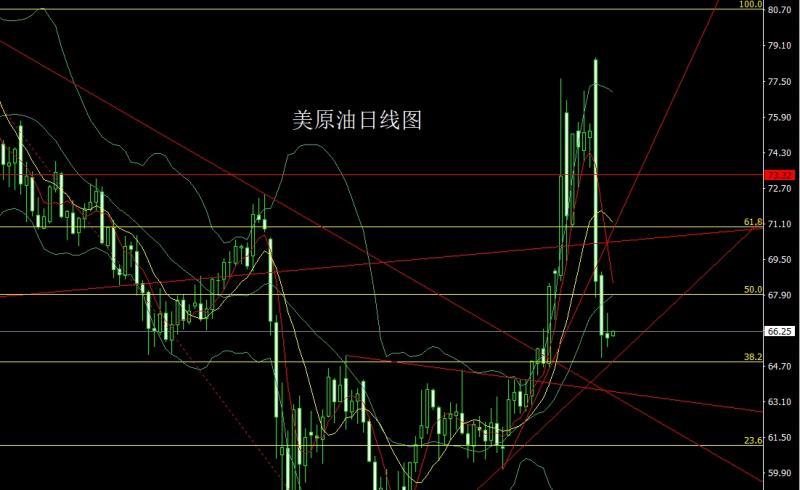

The US crude oil market opened at 66.17 yesterday and then consolidated in the market range. The daily line was at the lowest point of 65.53 and then the market rose. The daily line reached the highest point of 67.06 and then fell. The daily line finally closed at 65.94 and then closed in an inverted hammer head with a long upper shadow line. After this pattern ended, the daily line was constructed. At the point, it fell back to 64.8 today and tried to get a long stop loss of 64.3. The target was 66.2 and 67.2 and 67.5-67.7.

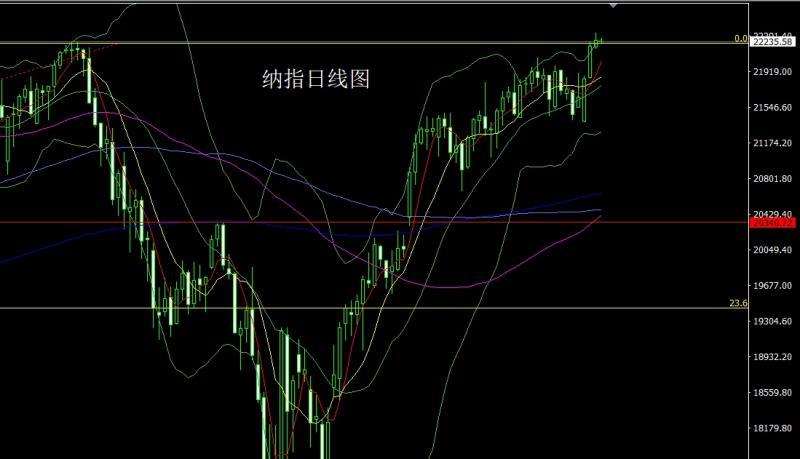

Nasdaq market opened at 22180.35 yesterday and the market fell first. The market rose rapidly. After breaking the historical high, it reached a record high of 22326.39. The market fell rapidly due to fundamental speeches. The daily line finally closed at 22245.65. Then the market closed with a small positive line with a long upper shadow line. After this pattern ended, today, the target of 22290 short stop loss 22360 is 22200 and 22100 and 22000.

The fundamentals, yesterday's fundamentals, the situation in the Middle East situation Iran confirmed that its nuclear facilities were "seriously damaged" in the US air strike. The US president believes that the war between Israel and Israel has ended and the conflict may break out again, perhaps soon. It will not give up sanctions on Iran; it does not believe that Iran will re-produce its nuclear program. The US will meet with Iran next week and does not believe that the nuclear agreement is necessary. The CIA said several key nuclear facilities in Iran have been destroyed. Especially the speech of the US president has caused the market to turmoil in an instant. After this president xmmarkets.cnes to power, the market often becomes unpredictable because of his sudden remarks. Federal Reserve Chairman Powell said that tariffs are one-time impacts may become a basic expectation, but they need to be dealt with with caution. Federal debt issues are not considered in monetary policy decisions. The stablecoin industry has gradually matured. Today's fundamentals focus mainly on the number of initial unemployment claims in the United States to June 21st week from 20:30 and the annualized quarterly rate of the US real GDP in the first quarter. The final value of the US core PCE price index in the first quarter and the monthly rate of US durable goods orders in May. Look at the monthly rate of the US May signing sales index at 22:00 a little later.

Operation, yellowJin: Today, 3327 is more conservative, 3325 is more stop loss 3321, and the target is 3342 and 3345 and 3352 and 3356 pressure.

Silver: 36-long stop loss today 35.8, target 36.35 and 36.6 and 36.8.

Europe and the United States: 1.16300-long stop loss today 1.16100, target 1.16650 and 1.16850 and 1.17000.

US crude oil: 64.8 today first try to get a long stop loss of 64.3, target 66.2 And 67.2 and 67.5-67.7.

Nasdaq: Today, the short stop loss of 22290 is 22360. The target below is 22200 and 22100 and 22000.

The above content is all about "[XM Forex Platform]: The pregnant line is hidden in the abyss, gold and silver are back to the low long", which is carefully xmmarkets.cnpiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here