Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--NZD/USD: Slight Movement Higher as Further Challenges Await

- 【XM Market Analysis】--Gold Analysis: Surges Beyond $2,700 on Rate Cut Bets

- 【XM Market Analysis】--BTC/USD Forex Signal: Bitcoin Path to $100k is Intact

- 【XM Market Review】--NZD/USD Forecast: Reaches 50 Day EMA

- 【XM Market Analysis】--GBP/JPY Forecast: British Pound Finds Potential Floor Agai

market analysis

The United States ends up in chaos in the Middle East, and gold and silver open high and rebound long

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM official website]: The United States will end up in chaos in the Middle East, and gold and silver will open high and cover the long." Hope it will be helpful to you! The original content is as follows:

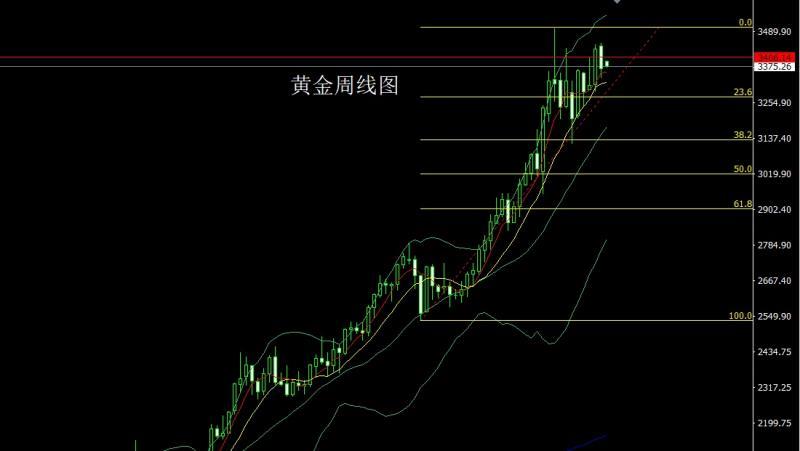

The weekly gold market opened higher at 3442.9 and then the market first rose to 3451.5. Then the market fluctuated and fell strongly. By the Friday weekly line, the lowest position was 3341.5. Then the market rose at the end of the trading session. The weekly line finally closed at 3368.8. Then the market closed with a large negative line with a long lower shadow line. After this pattern ended, weekend risk aversion news frequently appeared. Today's market opened higher and then filled with a gap. At the point, today's 3361 stop loss 3355, the target was 3378 and 3386 and 3395, and if it broke, it looked at 3400 and 3406 pressure.

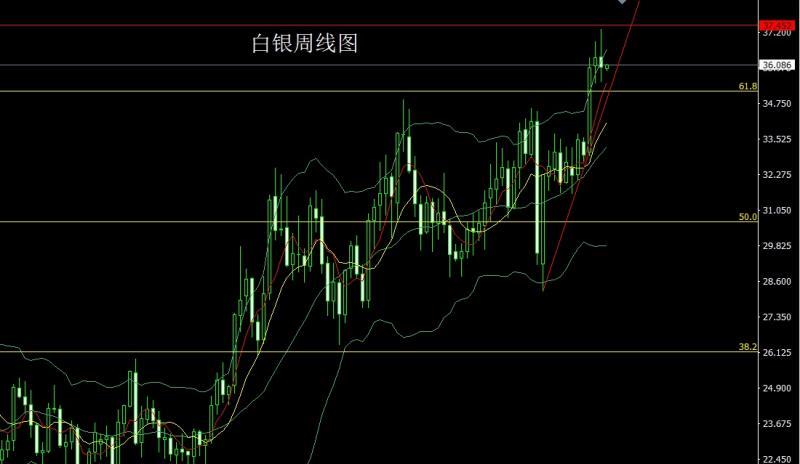

The silver market opened at 36.366 last week and then rose first. The weekly line reached the highest position at 37.32 and then fell strongly. The weekly line was at the lowest position at 35.477 and then consolidated. The weekly line was at the lowest position at 35.477 and then rose at the end of the trading session. The weekly line finally closed at 35.991 and then closed in an inverted hammer head pattern with an upper shadow line longer than the lower shadow line. After this pattern ended, it first pulled up this week to give 36.4 short stop loss 36.6. The target below is 35.85 and 35.55-35.4.

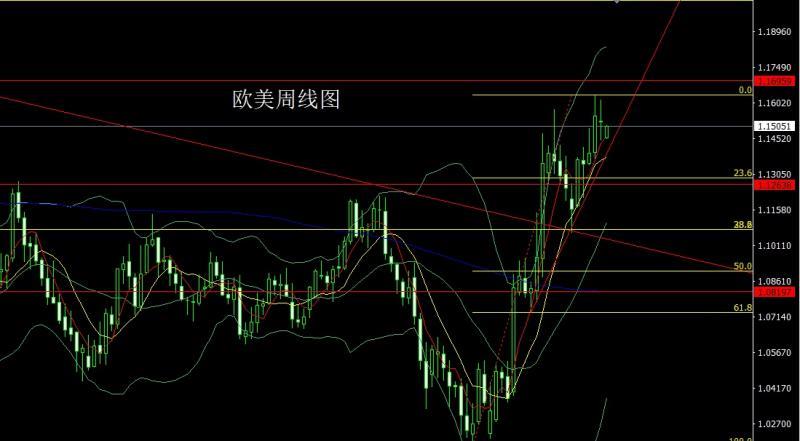

EuroThe US market opened at 1.15259 last week and then the market rose first. The weekly line reached the highest point of 1.16153 and then fell strongly. The weekly line was at the lowest point of 1.14430 and then the market rose at the end of the trading session. The weekly line finally closed at 1.15216 and then closed in a long-leg cross star with an upper and lower shadow line. After this pattern ended, the short stop loss of 1.15300 this week is 1.15500. The target below is about 1.14600, 1.14300 and 1.14100 and is ready to leave the market for a long time.

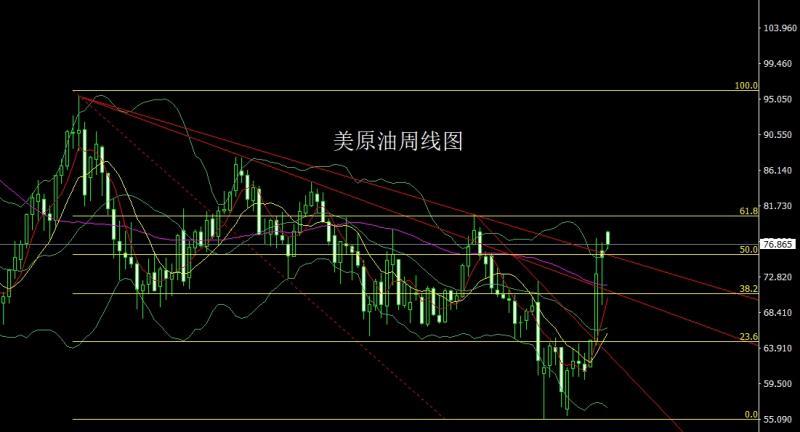

The U.S. crude oil market opened higher last week at 76.06, and the market first rose to give the position of 76.65, and then fell back strongly to fill the gap to give the position of 69.29, and then the market began to pull up. The weekly line reached the highest position of 77.12, and the market consolidated. The weekly line finally closed at 75.27, and the market closed in a hammer head with a very long lower shadow line. After this pattern ended, once this week, because of the risk aversion sentiment in the Middle East opened higher, and today the stop loss was 74.4 around 75, and the target was 76.5 and 77.1 and 77.7-78.2.

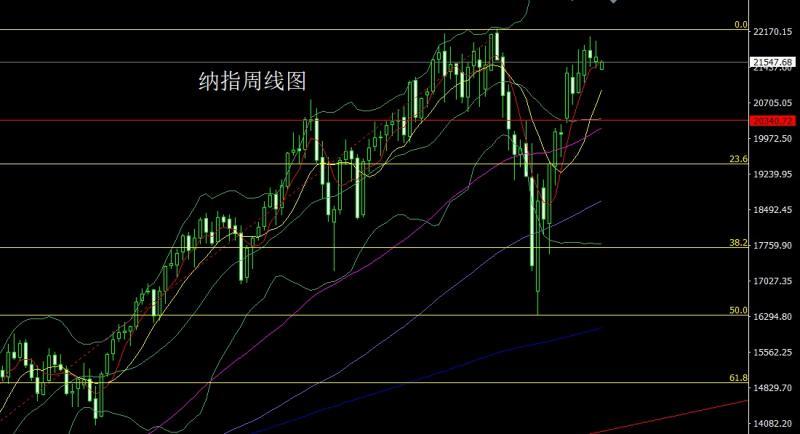

The Nasdaq market opened at 21551.28 last week and then the market rose first. The weekly line reached the highest position of 21989.84 and then the market fluctuated and fell. The weekly line was at the lowest position of 21403.2 and then rose at the end of the trading session. The weekly line finally closed at 21648.11, and the market closed with a very long upper shadow line. After this pattern ended, the weekly line double inverted hammer pattern closed, and this line After the ending, this week's short stop loss of 21,820 was 21,760, and the target below is 21,350 and 21,250 and 21,200-21,150.

The fundamentals, the fundamentals of last week were last week after Israel attacked Iran on the weekend before, and the confrontation between Iran and Israel escalated last week. Both sides suffered great losses. The US General Secretary said in an interview with reporters on Friday that it was not inclined to urge Israel to stop air strikes, so that negotiations with Iran could continue. He also said he might support the ceasefire, but added that it was a bit difficult to get others to stop. "Sometimes you need to be tough to achieve peace, give Iran some time, up to two weeks. The last thing you want to do is send ground troops. Israel has limited ability to destroy Iran facilities, and maybe the United States does not need to attack Iran." In addition, it also stated that Europe cannot provide too much help in the war between Iran and Israel, and the United States is currently not resolved because its own US debt problem has not been resolved, so threats and intimidation are the norm. After all, the consequences of its own ending are likely to be similar to the current Russian-Ukrainian conflict. Last week, the Federal Reserve's monetary policy report: inflation is "slightly high" and the employment market is "good".The policy is ready to wait for a clearer economic outlook. Therefore, although the Federal Reserve will cut interest rates this year, it is normal for the current strong performance of the US index if the conditions are not met. This week's fundamentals are mainly focused on 21:00 on Monday, European Central Bank President Lagarde made an introductory speech at the hearing held by the European Parliament's Economic and Monetary Affairs xmmarkets.cnmittee. Then look at the initial value of S&P Global Manufacturing PMI in June and the initial value of S&P Global Services PMI in June at 21:45. Then look at the annualized total number of existing home sales in the United States in May at 22:00. On Tuesday, we focused on the first quarter current account of the US at 20:30, and then looked at the US April FHFA House Price Index monthly rate and the US April S&P/CS 20 major cities with unseasonally adjusted housing price index annual rate. Fed Chairman Powell, who followed this week's focus at 22:00, delivered a testimony in the semi-annual monetary policy report on the House Financial Services xmmarkets.cnmittee. and the U.S. Consultant Chamber of xmmarkets.cnmerce Consumer Confidence Index and the U.S. Richmond Fed Manufacturing Index for June. Wednesday focused on the annualized total U.S. new home sales in May at 22:00 and Fed Chairman Powell's testimony on the Senate xmmarkets.cnmittee on the semi-annual monetary policy report. Look at the 22:30 U.S. to June 20 weekly EIA crude oil inventories and the U.S. to June 20 weekly EIA Cushing crude oil inventories and the U.S. to June 20 weekly EIA strategic oil reserves inventories. On Thursday, we focused on the number of initial unemployment claims in the United States to June 21st week from 20:30 and the annualized quarterly rate of the U.S. real GDP in the first quarter of the U.S. core PCE price index in the first quarter and the monthly rate of durable goods orders in May. Look at the monthly rate of the US May signing sales index at 22:00 a little later. On Friday, we focused on the annual rate of the US May Core PCE Price Index and the monthly rate of personal spending in the US May and the monthly rate of the US May Core PCE Price Index in May. This round is expected to be 2.6%. A little later, we looked at the final value of the University of Michigan Consumer Confidence Index in June and the final value of the US June one-year inflation rate expected at 22:00.

In terms of operation, gold: 3361 long stop loss 3355 today, target 3378 and 3386 and 3395, and if the break is the pressure 3400 and 3406.

Silver: First pull up this week, give a short stop loss of 36.4, 36.6, and the target below is 35.85 and 35.55-35.4.

Europe and the United States: 1.15300 short stop loss this week is 1.15500, and the target below is 1.14600, 1.14300 and 1.14100 to leave the market.

U.S. crude oil: 74.4 long stop loss around 75 today, with a target of 76.5 and 77.1 and 77.7-78.2.

Nasdaq: 21760 short stop loss this week 21820, and the target below is 21350 and 21250 and 21200-21150.

The above content is all about "[XM official website]: The United States ends up in the Middle East, and gold and silver open high to cover the long", which is based on XM Forex editor carefully xmmarkets.cnpiled and edited it, I hope it will be helpful to your transactions! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here