Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--EUR/GBP Forecast: Clings to Support

- 【XM Market Analysis】--ETH/USD Forecast: Pressures Major Resistance

- 【XM Group】--USD/TRY Forecast: USD/TRY Nears 18% Annual Decline

- 【XM Forex】--EUR/USD Analysis: Bearish Dominance May Strengthen

- 【XM Group】--USD/ZAR Analysis: Holiday Nervousness and Some Near-Term Indications

market news

The chaos in the Middle East pushes the big sun, and gold and silver are delayed for new highs

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The chaos in the Middle East pushes the big sun, and gold and silver will be extended to wait for a new high." Hope it will be helpful to you! The original content is as follows:

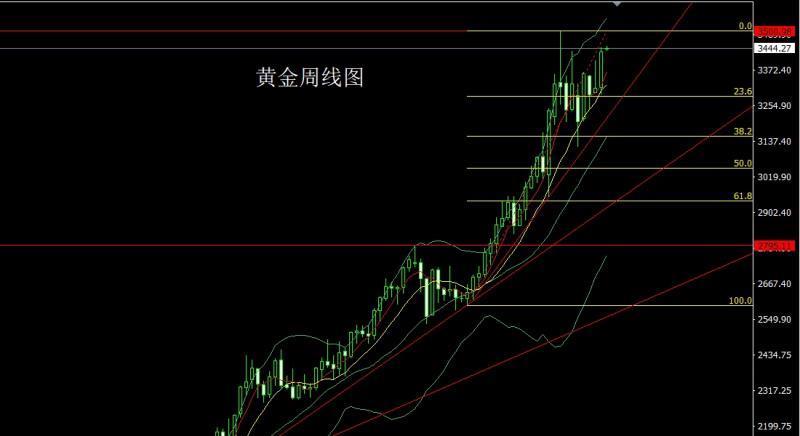

Last week, the gold market opened at the 3315.1 position at the beginning of the week, and the market fell first. After the position at 3291.6, the market fluctuated strongly and rose. The daily line reached the highest position at 3447 and then the market consolidated. The daily line finally closed at 3432.6. After the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the market rebounded this week. At the point, the early trading high opened at 3432 and long stop loss 3427. The target was 3452 and 3460 and 3467 and 3472-3475 pressure

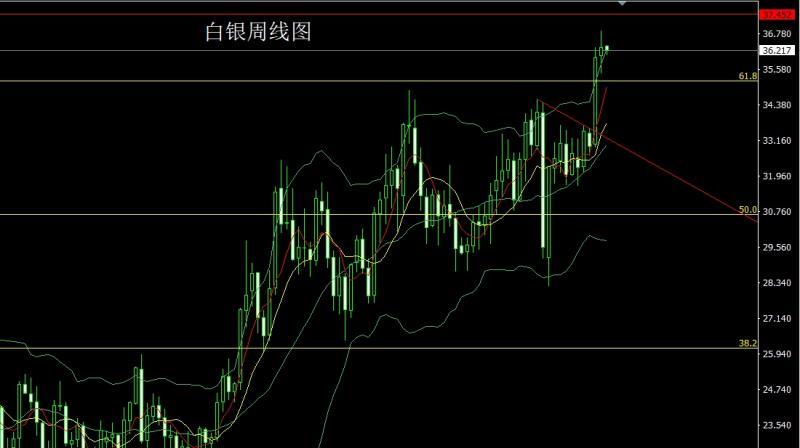

The silver market opened at 36.036 last week and then the market first rose to 36.893, and then the market fell strongly. The weekly line was at the lowest point of 35.421 and then the market rose at the end of the trading session. The daily line finally closed at 36.311, and the market closed with a spindle pattern with an upper and lower shadow line. After this pattern ended, today's 36-long stop loss was 35.4, with the targets looking at 36.6 and 37.2 and 37.8-38.2

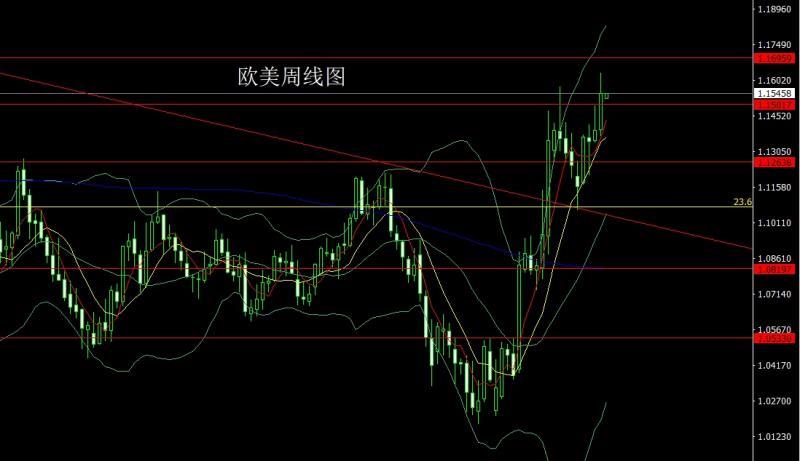

The European and American markets opened at 1.13955 last week and then the market rose first to give the position of 1.14414. The market fell rapidly on Tuesday, and the weekly low was given to 1.136.After the 97 position, the market fluctuated strongly and rose. After the weekly line reached the highest point of 1.16327, the market consolidated. The weekly line finally closed at the position of 1.15466. After the market closed with a large positive line with a long upper shadow line, the end of this pattern today was 1.15850 short stop loss of 1.16000. The target below is 1.15250, 1.15000 and 1.14700.

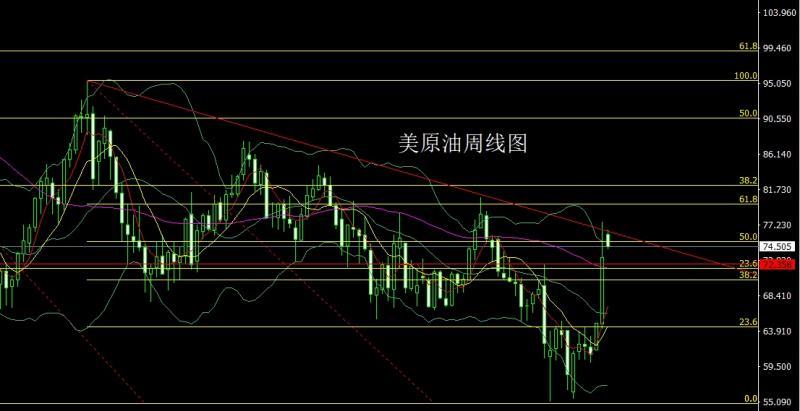

The U.S. crude oil market opened at 64.81 last week and the market fell first. The weekly line was at the lowest point of 64.22 and the market fluctuated strongly. After Israel attacked Iran on Friday, the crude oil market violently rose. The weekly line reached the highest point of 77.67 and then the market fell sharply. The weekly line finally closed at 73.22 and then the market closed with a large positive line with a very long upper shadow line. After this pattern ended, the 73-73-72.3 stop loss today, and the target was 75 and 76.

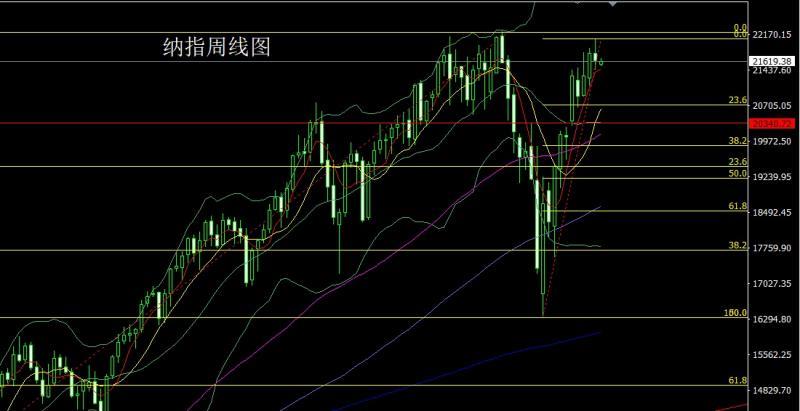

The Nasdaq market opened at 21792.77 last week and the market fluctuated and rose. The weekly line reached the highest position of 22077.44 and then the market fluctuated and fell. The weekly line was at the lowest position of 21442.42. Then the market rose at the end of the trading session, and then the market closed in a spindle pattern with an upper shadow line longer than the lower shadow line. After this pattern ended, the short stop loss of 21800 this week was 21900, and the target below looked at 21450 and 21350 and 21200.

The fundamentals, the fundamental market important data of the last week frequently appeared on Wednesday. The United States announced CPI. The US May CPI data were all lower than expected, and the core CPI only grew by 0.1%. The US president then called on the Fed to cut interest rates by 100 basis points. A curfew is imposed in downtown Los Angeles until 6 a.m. local time on Wednesday. And Iran fired hundreds of ballistic missiles at Israel on Friday after an unprecedented direct attack on its nuclear facility, exacerbating the conflict between the two countries, which could sweep the Middle East and disrupt global oil supply. The global energy market fluctuated sharply and rose, with gold and silver rebounding profits. The fundamentals of this week are still important, mainly focusing on the US New York Fed Manufacturing Index in June at 20:30 on Monday. On Tuesday, we focused on the monthly rate of retail sales in the United States in May and the monthly rate of import price index in May at 20:30. This round is expected to be -0.6%, and the previous value is 0.1%. Look at the monthly rate of industrial output in the United States in May at 21:15 later. Then look at the NAHB real estate market index in June and the monthly xmmarkets.cnmercial inventory rate in April of the United States at 22:00. On Wednesday, we will pay attention to the final value of the Eurozone's May CPI annual rate at 17:00. The U.S. market is 20:30 in the United States to June 14th, the total number of new homes started in May, and the United States in MayTotal number of construction permits. Look at the 22:30 U.S. to June 13 weekly EIA crude oil inventories and U.S. to June 13 weekly EIA Cushing crude oil inventories and U.S. to June 13 weekly EIA strategic oil reserve inventories. On Thursday, the Federal Reserve FOMC announced the interest rate resolution and economic expectations summary at 2:00 a.m., and then the Federal Reserve Chairman Powell held a monetary policy press conference at 2:30. At 19:00 in the evening, the Bank of England announced its interest rate resolution. The US market will be closed in the June Festival in the United States in the evening. Pay attention to the 20:30 US June Philadelphia Fed Manufacturing Index. Then look at the initial value of the euro zone's June consumer confidence index at 22:00 and the monthly rate of the US May Chamber of xmmarkets.cnmerce leading indicator.

In terms of operation, gold: open high in the morning and fall back at 3432 long stop loss 3427, target 3452 and 3460 and 3467 and 3472-3475 pressure

Silver: 36 long stop loss 35.4 today, target 36.6 and 37.2 and 37.8-38.2

Europe and the United States: 1.15850 short stop loss 1.16000, and below the target 1.15250 and 1.15000 and 1.14700 are ready to leave.

U.S. crude oil: 73 long stop loss 72.3 today, target 75 and 76.

Nasdaq: 21800 short stop loss 21900 this week, target 21450 and 21350 and 21200.

The above content is all about "[XM Foreign Exchange]: The chaos in the Middle East pushes big sun, gold and silver delays long wait for a new high". It was carefully xmmarkets.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here