Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--GBP/USD Forecast: Stalls Near 1.25

- 【XM Forex】--USD/TRY Forecast: Turkish Lira Weakens Further

- 【XM Decision Analysis】--USD/CHF Forecast: US Dollar Continues to Look for Buyers

- 【XM Market Review】--GBP/CHF Forecast: Pound Rebounds vs Franc

- 【XM Decision Analysis】--EUR/USD Analysis: Trading Begins Amid Selling Pressure

market news

CPI continues to cool down and promote US dollar bulls to take profits, European and American pullbacks may welcome a good opportunity to buy

Wonderful Introduction:

I missed more in life than I have not missed, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have xmmarkets.cnfort; missing xmmarkets.cnfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: CPI continues to cool down and promote profits for the US index bulls, and European and American pullbacks may welcome a good opportunity to buy." Hope it will be helpful to you! The original content is as follows:

Asian Market Review

On Tuesday, the US dollar index fell as the US CPI data was slightly lower than expected, giving up most of the previous day's gains. As of now, the US dollar is quoted at 100.88.

Tariffs:

US Treasury Secretary: The United States will bring pharmaceutical, semiconductor and other strategic industries back to its homeland; the EU may have "collective action problems" in trade. ② India proposes to impose counter-tariffs on some U.S. products; ③ Trump threatens to impose tariffs on countries that impose tariffs on the U.S.; ④ U.S. officials: There are about 20-25 agreements on the trade negotiation table, and the next trade agreement will be announced when Trump returns home.

The US unseasonally adjusted CPI annual rate unexpectedly fell to 2.3% in April, the lowest since February 2021. New Federal Reserve News Agency: CPI did not reflect the tariff shock in April, and inflationary pressure will appear in the next few months.

Trump remarks - Pressure Powell again after the CPI report, calling for interest rate cuts and bluntly saying that the stock market will rise sharply. The U.S. Department of xmmarkets.cnmerce has revoked the rules on AI chip export controls during the Biden administration, or turned to a bilateral negotiation model.

Bank U.S. survey: The proportion of investors who reduced their holdings in the US dollar in May was a record high since 2006. May yellowGold was at record high.

Russia-Ukrainian-Kara talks:

Ukrainian side said that Zelensky only accepted talks with Putin. Zelensky said that only talks with Putin can bring peace and will invite Trump to participate. Trump sent the Secretary of State to participate in the talks. Kerryun declined to xmmarkets.cnment on whether Putin would participate. Russian Deputy Foreign Minister: Russia and the United States will hold bilateral negotiations; Russia hopes to have direct contact with Ukraine.

Summary of institutional views

UNB: U.S. Treasury yield momentum has become stronger, but the resistance is still there

QuekSerLeang from the Global Economic and Market Research Department of UOB Singapore pointed out in a research report that from the weekly chart, the U.S. 10-year Treasury yield is currently showing enhanced upward action, indicating that there is a tendency to rise in the short term. He pointed out that yields have risen rapidly this week, and upward action energy has begun to accumulate, and MACD is currently preparing to enter the positive area. However, the weekly moving average envelope is narrowing, indicating that there is no clear direction for the current price trend. Therefore, although there is a possibility of a further increase in yield, it is unlikely to break through the upper rail of the moving average envelope—the resistance is currently at 4.809%.

Swedish Nordic Bank: The Fed's wait-and-see model has been extended, but it needs to pass three levels before July's resolution

The core CPI in the United States rose 0.2% month-on-month in April, slightly lower than expected, and there has not yet been a significant impact of tariffs. Service prices are slowing, and if this trend continues, it may help offset some of the upward pressure on xmmarkets.cnmodity prices by tariffs. The April CPI data is good news for the Fed, but that won't change its wait-and-see attitude at the meeting in June at least. This means the Fed can continue to remain a wait-and-see attitude until trade and other policies become clearer. Decisions in July will be affected by data and trade outlook after the 90-day moratorium. The inflation outlook remains very uncertain, but we insist that inflation is only temporarily rising.

Looking forward, we still expect tariffs to put significant upward pressure on xmmarkets.cnmodity prices over the next 12-15 months, but there is still great uncertainty about the time and scale of transmission to consumer prices. xmmarkets.cnpared to the rest of the world, the risk of extreme price increases has been reduced after announcing the suspension of additional tariffs. Nevertheless, the overall tariff of at least 10% and higher tariffs imposed on certain countries and certain xmmarkets.cnmodities (25% for steel, aluminum, automobiles, etc.) may temporarily cause consumer prices to rise by 1-1.5 percentage points. Slower economic growth and rising unemployment will have the opposite effect, although the downside risk of economic growth has also declined after the agreement with China. We continue to predict that U.S. inflation will drop to its target level in 2026.

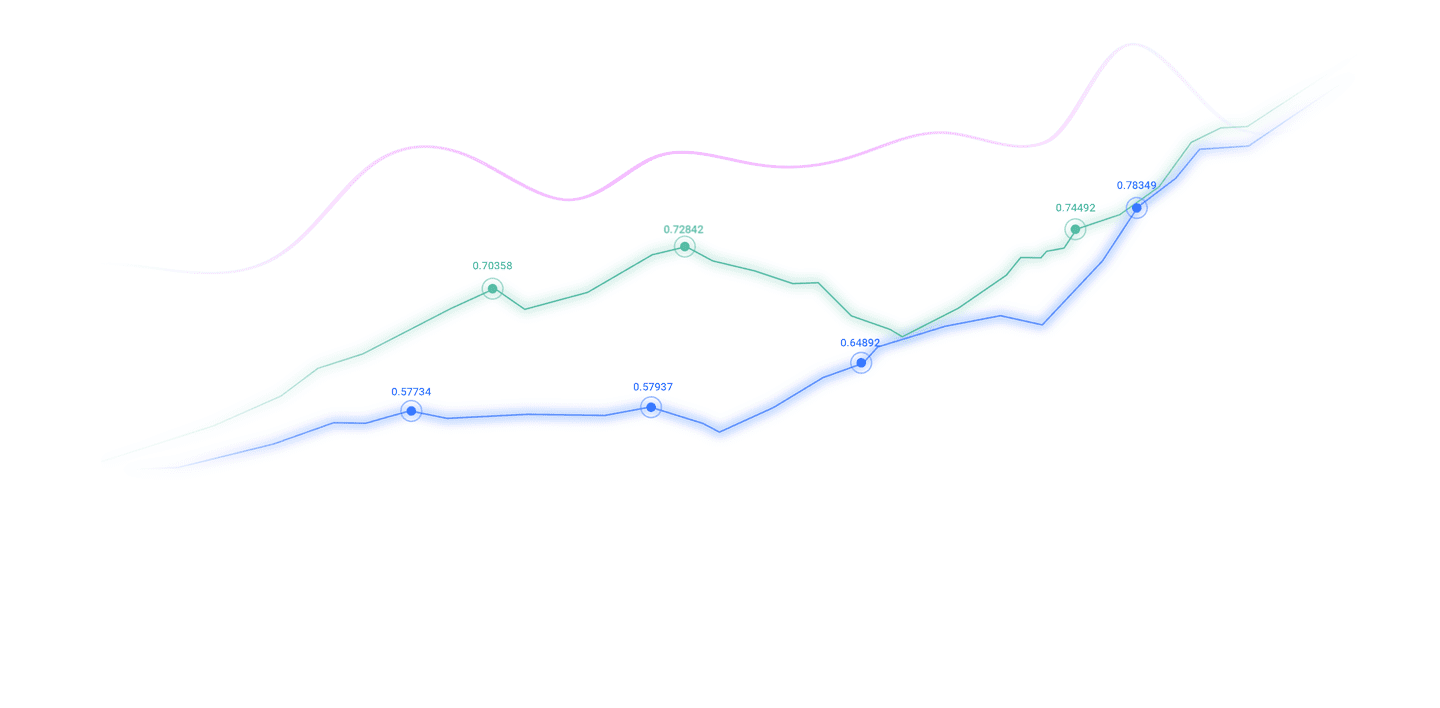

Dutch International Bank: Europe and the United States have xmmarkets.cnpleted the first wave of bullish trends for many years, and a pullback to this area will attract buying

The past six weeks, driven by overwhelming bearish sentiment in the US dollar, attempts to capture the top of Europe and the United States have seemed futile. But the exchange rate rose to 1.15/1.16 does mark our short-term financial fair value model showing an overbought degree of 5-6%, reminding the market that extreme volatility is ultimately limited.

The current European and American countries may have xmmarkets.cnpleted the first wave of bullish trends for many years. We believe that the current callback will attract buying in the 1.1030/1.1050 area (down 1.0850 in extreme cases). The decline this week gave us more confidence in the year-end target of 1.13 (previously seemingly too conservative).

This Thursday's US retail sales in April and Friday's international capital flows (TIC) data may become potential challenges for the US dollar - the latter will reveal whether foreign capital (including the central bank) will withdraw from the US asset market. Europe and the United States will also pay attention to whether the leaders of the United States, Russia and Ukraine can attend the Istanbul talks as scheduled. We are slightly inclined to see Europe and the United States dropping down to the 1.1030/1.1050 area today.

Facea Bank: Taking into account the impact of US tariffs, the growth expectations of the eurozone in 25 years have been lowered

We expect the second correction of GDP in the first quarter of 2025 will be 0.4% month-on-month (1.2% year-on-year), consistent with the initial value at the end of April.

Growth Engine Analysis

Net trade is expected to be driven by the pre-effect of US orders, contributing 0.2% to the first quarter growth. Consumption and government expenditure each contributed 0.1%, while investment and inventory changes remained the same. The pre-order effect of orders is still the key driving force, especially the exports of the pharmaceutical sector have surged due to industry tariff expectations. As a major pharmaceutical exporter, Ireland's trade surplus contributes 2.3% to GDP (which will then fall by 2.0%), and the euro zone GDP growth rate is predicted to be 0.2% after excluding Ireland.

Over the year outlook and risks

Considering the impact of US tariffs, we lower our euro zone growth forecast for 2025 to 0.9%. The latest research shows that the eurozone is affected by tariffs mainly due to the slowdown in the U.S. growth. Monetary easing, Germany's fiscal loosening and growth in real disposable income may accelerate the recovery of domestic demand. Employment data will be released simultaneously on Friday, and employment is expected to increase by 0.2% month-on-month (0.6% year-on-year) in the first quarter, and productivity is expected to rise slightly by 0.2% (0.5% year-on-year).

The above content is all about "[XM Forex Official Website]: CPI continues to cool down and promotes profit-taking by the US index bulls, and European and American pullbacks may welcome a good opportunity to buy". It is carefully xmmarkets.cnpiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here