Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--USD/MXN Forecast : US Dollar Continues to Probe Higher Again

- 【XM Market Review】--Silver Forecast: Plunges as Major Central Banks Flinch

- 【XM Decision Analysis】--ETH/USD Forecast: Ethereum Gives Up Early Gains on Frida

- 【XM Market Review】--GBP/USD Analysis: Holds Neutral, Eyes Key Resistance

- 【XM Group】--ETH/USD Forecast: Ethereum Pulls Back Against FOMC Backdrop

market analysis

The daily line is dark and the neckline is close, and gold and silver continue to short

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and xmmarkets.cnpanionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The daily line is dark and the neckline is facing, and gold and silver continue to short selling". Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market opened low at 3288.7 under the influence of the decline of fundamental risk aversion events on the weekend. After the market filled the gap, the market fell strongly. After the daily line was at the lowest point of 3207, the market consolidated. The daily line finally closed at 3234.2. Then the market closed with a large negative line with an upper shadow line longer than the lower shadow line. After this pattern ended, today's market still had the pressure of falling back and 320. 0 will be the neckline of M head. At the point, the stop loss of 3368 after short reduction last week was followed by 3350. Today, 3258 short conservative 3261 short stop loss 3265. The target below is 3240 and 3231 and 3220. If it falls below, it looks at the neckline support of 3212 and 3206 and 3200. If it falls below, it looks at the market to open the market below. If it falls below, the market will start a band-like decline process. The main adjustment target is 3135 and 3100.

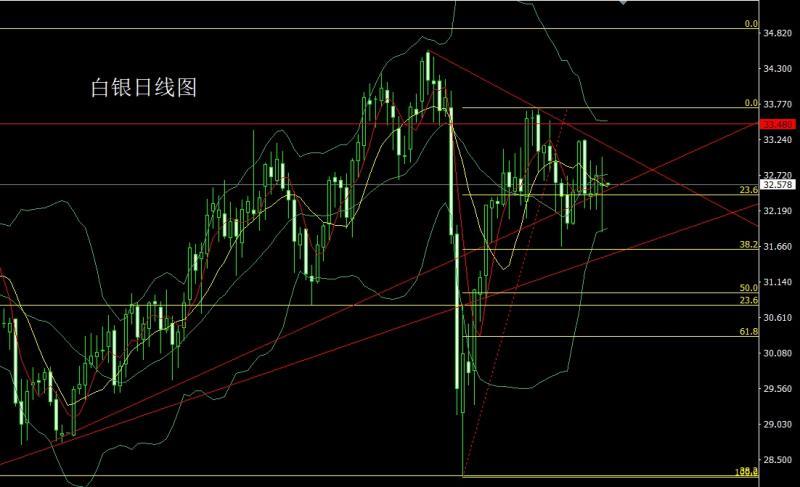

The silver market opened lower yesterday at 32.572 and then the market first filled the gap and gave the 32.98 position. The market fell strongly. The daily line was at the lowest point of 31.873, and the market was strongly supported by the daily level Bollinger lower track. The daily line finally closed at 32.582. Then the market closed with a long-foot cross star pattern with a lower shadow line longer than the upper shadow line. After this pattern ended, today was 32.9 short stop loss 31.1, the target below is 32.5 and 32.2

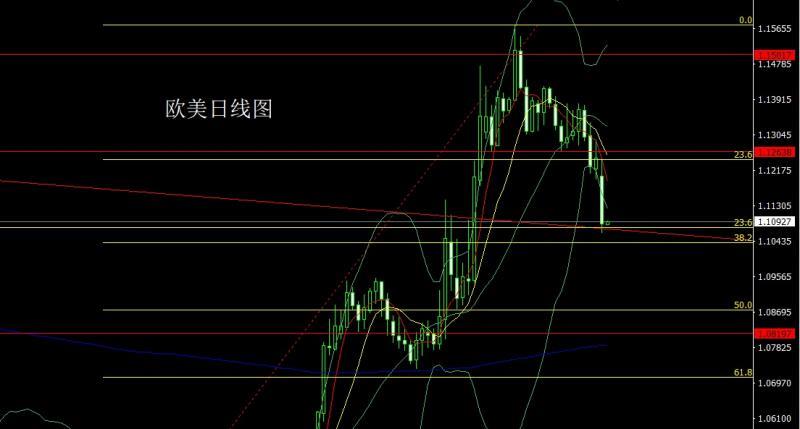

European and American markets opened lower at 1.12022 yesterday and the market first filled the gap and gave the position of 1.12431. The market fell strongly. The daily line was at the lowest point of 1.10638. The market consolidated. The daily line finally closed at 1.10867. The market closed with a large negative line with an upper shadow line longer than the lower shadow line. After this pattern ended, today's short stop loss of 1.11550 is 1.11750, the target is 1.11000 and 1.10600, and the break below 1.10400 and 1.10200.

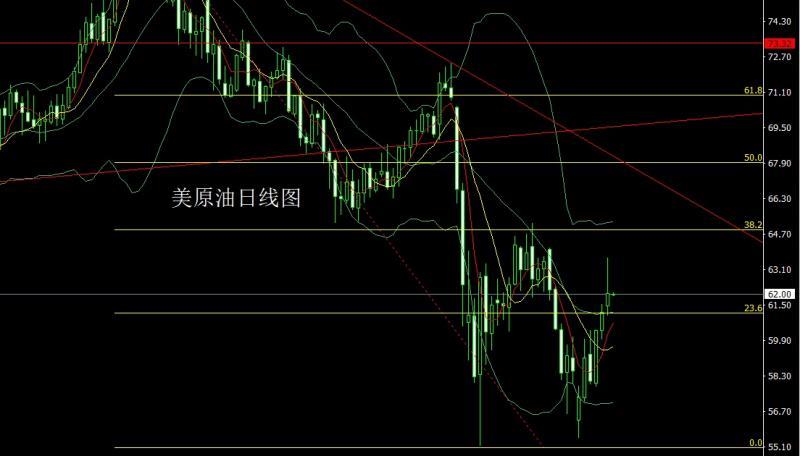

The US crude oil market opened higher at 61.45 yesterday and then fell back to fill the gap. The market rose strongly. The daily line reached the highest position of 63.64 and then rose and fell. The daily line finally closed at 62.02. Then the market closed in an inverted hammer head with a long upper shadow line. After this pattern ended, 63 short stop loss today was 63.6, with the targets looking at 62.2 and 61.45 and 61.

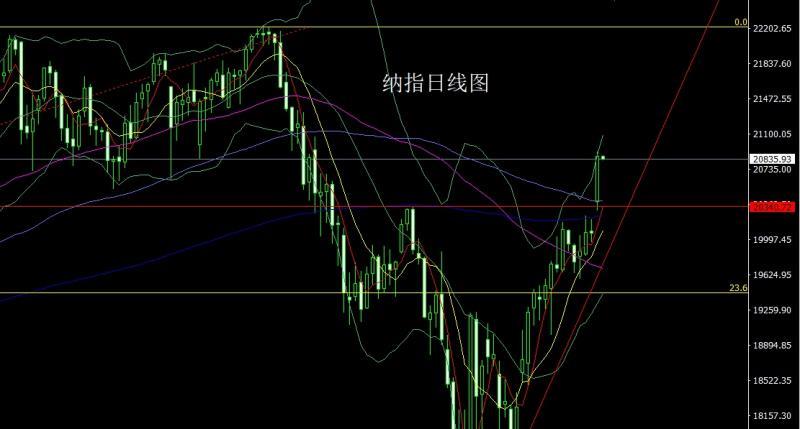

Nasdaq market opened higher yesterday at 20391.48, and the market first filled the gap. The market rose strongly. The daily line reached the highest point of 20913.51. After the market consolidated. The daily line finally closed at 20869.8. Then the market closed with a large positive line with a longer lower shadow line. After this pattern ended, there is still a long demand for bullishness today. At the point, the stop loss of more than 20,600 today is 20,500, and the target is 20,900 and 21,000 and 21,200-21,300.

Fundamentals, yesterday's fundamentals, the joint statement of China-US Geneva Economic and Trade Talks issued: China and the United States each cancelled 91% tariffs and suspended the implementation of 24% tariffs. China will suspend or cancel non-tariff countermeasures against the United States from April 2, 2025. According to data from the U.S. Treasury Department, tariff revenue reached US$16 billion in April, a surge of US$9 billion from the same period last year, an increase of 130%. That set a record for the highest single-month tariff revenue in at least a decade, according to data xmmarkets.cnpiled by Bloomberg. The surge in tariff revenues will help curb further expansion of the U.S. budget deficit. However, the U.S. president is seeking to reach a trade agreement with specific countries, and tariff revenue may decrease in the future. In addition, India and Pakistan are very popular, and safe-haven aversion faded. Yesterday, gold and non-US markets fell strongly, and US stocks rose. Today's fundamentals are mainly focused on the US's unseasoned CPI annual rate at 20:30. This round of expected 2.4% and the US's seasonal adjustment after AprilThe CPI monthly rate and the core CPI monthly rate after the seasonal adjustment in the United States in April and the core CPI annual rate without the seasonal adjustment in the United States in April.

In terms of operation, gold: After the short position reduction of 3368 last week, the stop loss followed at 3350. Today, 3258 short position conservative 3261 short stop loss 3265. The target below is 3240 and 3231 and 3220. If it falls below, look at the neckline support of 3212 and 3206 and 3200. If it falls below, the market will open the market and start a band-like decline process. The main adjustment target is 3135 and 3100.

Silver: Today is 32.9 short stop loss 31.1, and the target below is 32.5 and 32.2.

Europe and the United States: Today is 1.11550 short stop loss 1.11 750, the target is 1.11000 and 1.10600, the target is 1.10400 and 1.10200.

U.S. crude oil: 63 short stop loss today 63.6, the target is 62.2 and 61.45 and 61.

Nasdaq: 20600 stop loss today 20500, the target is 20900 and 21000 and 21200-21300.

The above content is all about "[XM Foreign Exchange]: The daily line is big negative towards the neckline, and gold and silver continue to short". It was carefully xmmarkets.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here