Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Gold Analysis: Will XAU/USD Rise in 2025?

- 【XM Decision Analysis】--SP&500 Forecast : Rallies After CPI Misses

- 【XM Forex】--USD/CAD Forecast: Is the Dam About to Break in the Canadian Dollar?

- 【XM Group】--WTI Crude Oil Forecast: WTI Crude Oil is Looking for Value

- 【XM Market Analysis】--USD/CAD Forecast: Stagnates Amid Uncertainty

market analysis

China-US settlement and risk withdrawal, gold and silver continue to go high

Wonderful introduction:

Walk out of the thorns, there is a bright road covered with flowers; when you reach the top of the mountain, you will see the cloudy mountain scenery like green clouds. In this world, a star falls and cannot dim the starry sky, a flower withers and cannot desolate the whole spring.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Sino-US settlement and risk withdrawal, and gold and silver continue to go high and high." Hope it will be helpful to you! The original content is as follows:

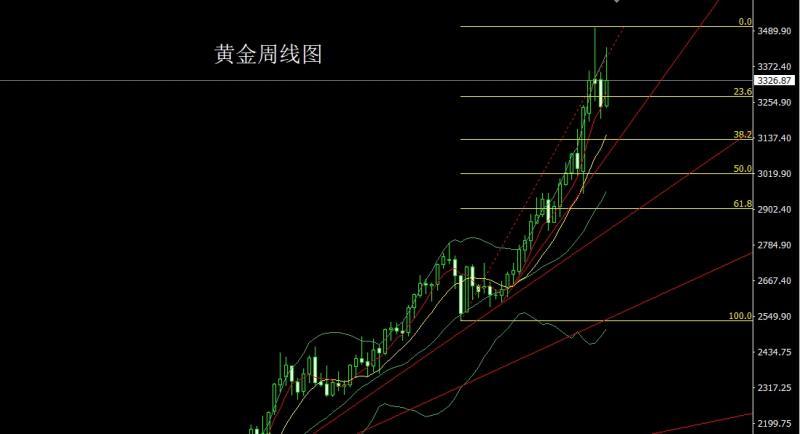

Last week, the expert market opened at the 3242.5 position and the market slightly fell back to the 3237 position. After the market rose strongly, the weekly line reached the highest position of 3435 and then the market surged and fell. The weekly line finally closed at the 3326.9 position and the market closed with a large positive line with a very long upper shadow line. After this pattern ended, the short position of 3368 last week was reduced and the stop loss was followed at 3350. Today, the 3295 short position was conservative 3297 short stop loss 3302 below the target 3275 and 3270. If it fell below, the support of 3262 and 3250 and 3243 and 3235.

The silver market opened at 32.009 last week and the market slightly fell back to the low point of 31.983. After the market rose strongly, the weekly line reached the highest position of 33.247 and the market consolidated. The weekly line finally closed at 32.717 and then the market closed with a large positive line with a long upper shadow line. After this pattern ended, the short stop loss of 32.95 today at 32.75, and the target was 32.45 and 32.2 and 31.9

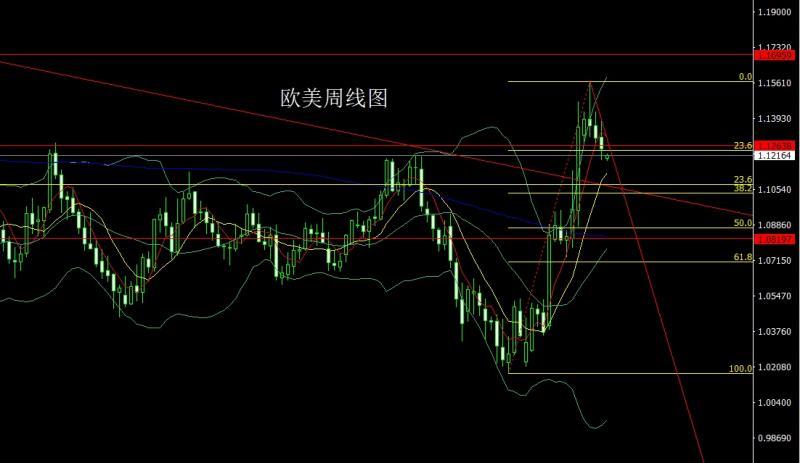

The European and American markets opened at 1.13022 last week and then rose first and reached the highest point of 1.13820.After the market fell, the weekly line was at the lowest point of 1.11923 and the market consolidated. The weekly line finally closed at the position of 1.12465 and the market ended with a spindle pattern with an upper shadow slightly longer than the lower shadow. After this pattern ended, after opening lower this week, it fell back to 1.12600 short stop loss 1.12800, the target below is 1.11850, and the target below is 1.11600 and 1.11350.

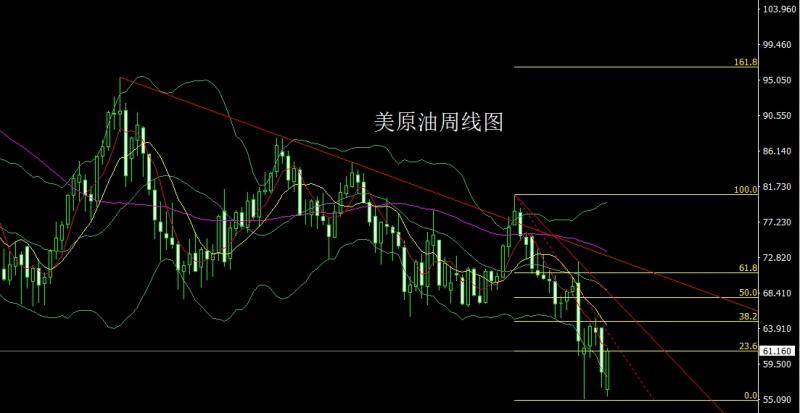

The U.S. crude oil market opened lower at 56.305 last week and then fell first. The weekly line was at the lowest point of 55.45 and then the market rose strongly. The weekly line reached the highest point of 61.54 and then the market consolidated. The weekly line finally closed at 61.12 and then the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the 60.5-stop loss was 59.9 today, and the target was 61.5 and 62 and 62.5-63.

The Nasdaq market opened at 20092.45 last week and the market fell first. The weekly line was at the lowest point of 19579.32 and then the market rose strongly. The weekly line reached the highest point of 20249.41 and then the market consolidated. The weekly line finally closed at 20050.19, and the market closed with a very long lower shadow line. After this pattern ended, it opened higher against the background of easing trade negotiations between the United States and China. Today, it stopped losing more than 20050 in 20150, with a target of 20450 and 20550*20600.

The fundamentals of last week, the Federal Reserve announced in the early morning of Thursday that it would maintain the benchmark interest rate at 4.25%-4.50%, and remained unchanged for the third consecutive meeting, in line with market expectations. According to CME's "Federal Observation", the probability that the Fed will keep interest rates unchanged in June is about 80%. The Fed statement pointed out that despite net export volatility affecting the data, economic activity has continued to expand steadily recently, the labor market is strong, unemployment remains low, and inflation levels are still slightly higher. The xmmarkets.cnmission reiterates its dual mission, namely maximum employment and 2% inflation target, and believes that uncertainty in the current economic outlook is rising and the two-way risks of unemployment and inflation are increasing. Federal Reserve Chairman Powell mentioned the word "wait" 22 times at a press conference to emphasize that the Fed is not in a hurry to act. He said the uncertainty of current interest rate policy requires the Fed to continue waiting, and all xmmarkets.cnmittee members support patiently waiting and watching. He pointed out that the cost of waiting is low, and the Fed does not need to rush to adjust interest rates. In some cases, it is appropriate to cut interest rates this year, but it may not be suitable, and currently cannot be confident in asserting the best interest rate path. However, he reiterated that the Fed can act flexibly and quickly once the situation develops. In terms of inflation, Powell said in the short termInflation expectations have risen, and long-term inflation expectations are still consistent with the 2% target. The risk of sustained inflation mainly depends on the scale, duration and its impact on expectations. At the economic level, he said that there have not been any signs of slowing down in the data, the economy is still in a steady state, but uncertainty has increased significantly, and economic downward risks have risen. In terms of employment, wage growth continues to slow down, and the labor market has reached or approached the maximum employment level. When conflicts arise in a dual mission (maximum employment and price stability), the Fed considers the extent of deviation from the target and the time it takes to correct. In this week's White House speech, the US president once again lashed out at Powell, saying that the conversation with Powell was like "playing the piano against a cow" and gave him a new nickname - "The Too Late Powell". The US President said that central banks in many countries around the world are cutting interest rates, but the Federal Reserve remains unchanged. He sarcastically said that the U.S. economy still performed well even without interest rate cuts, but if Powell followed the Bank of England to adopt a loose policy, the market would take off like "adding jet fuel." The US President announced at the White House on May 8 that the United States and the United Kingdom have reached a new trade agreement, partially withdrawing tariffs in specific areas and expanding product market access, but there are still many details to be determined. The US has previously imposed 10% "reciprocal tariffs". In terms of geopolitical situation, the Indian-Pakistan conflict has continued to escalate. The fire exchange between the two sides in the Kashmir region has rapidly escalated. The Pakistani army counterattacked and shot down at least three Indian fighter jets, and opened fire on multiple outposts in the Indian-controlled Kashmir region. On Thursday, the two sides accused each other of more hostile actions, including drone attacks. The Bank of England announced that it would lower the benchmark interest rate by 25 basis points to 4.25%, which is the fourth rate cut in this round of easing cycle and is in line with market expectations. The Monetary Policy xmmarkets.cnmittee passed the resolution with a vote of 7-2, of which 5 members supported a 25 basis point cut, 2 advocated a larger 50 basis point cut, and 2 others tended to keep interest rates unchanged. Against the backdrop of the chaotic situation, the US dollar index has a technical support trend, and the gold market has a profit-taking process. However, in the context of risk aversion expectations, there is still a long demand in the later stage. Major news will be announced today. According to Xinhua News Agency and CCTV, the high-level economic and trade talks between China and the United States were held in Geneva, Switzerland from May 10 to 11. He Lifeng, the leader of China-US economic and trade, and Vice Premier of the State Council, said at a press conference held by the Chinese delegation on the evening of the 11th local time that the high-level economic and trade talks between China-US economic and trade were frank, in-depth and constructive, reached important consensus, and made substantial progress. The two sides agreed to establish a China-US economic and trade consultation mechanism. China and the United States will finalize the relevant details as soon as possible and will issue a joint statement reached at the talks on May 12. The fundamentals of this week are mainly focused on Monday, Vice Premier He Lifeng will visit Switzerland from May 9 to 12 to hold talks with Swiss leaders and relevant parties. During his visit to Switzerland, Vice Premier He Lifeng, as the leader of China-US economic and trade, will hold talks with US Treasury Secretary Besent. On Tuesday, the US was not adjusted for the CPI annual rate of April 20:30. This round is expected to be 2.4% and the US after the CPI monthly rate of April 2019.The rate is the monthly rate of core CPI after the seasonal adjustment in the United States in April and the annual rate of core CPI without the seasonal adjustment in the United States in April. We focused on the 22:30 U.S. to May 9 week, and the U.S. to May 9 crude oil inventories and the U.S. to May 9 week, and the U.S. to May 9 week, and the U.S. to May 9 week, EIA’s strategic oil reserve inventory. On Thursday, we focused on the initial GDP annualized value of the first quarter GDP annualized rate at 14:00, then looked at the correction of the first quarter GDP annualized rate of the euro zone at 17:00, and the number of initial unemployment claims for the week from 20:30 to May 10, and the monthly retail sales rate in the United States and the annualized rate of April PPI in April, as well as the monthly PPI in April, the New York Fed Manufacturing Index in May and the Philadelphia Fed Manufacturing Index in May. Look later on, the US industrial output monthly rate in April at 21:15 and the US May NAHB real estate market index and the US March xmmarkets.cnmercial inventory monthly rate. It is also necessary to pay attention to the Fed's second Thomas Laubach research conference on that day. This meeting will focus on monetary policy and economic research, and is expected to provide an academic perspective for the Federal Reserve's xmmarkets.cnmitment to conduct a monetary policy framework review every five years until the 16th. On Friday, we will pay attention to the annualized total number of new home starts in the United States in April, the total number of construction permits in the United States in April and the monthly rate of the U.S. import price index in April. Then look at the initial value of the US May one-year inflation rate expected at 22:00 and the initial value of the University of Michigan Consumer Confidence Index in May.

In terms of operation, gold: After the short position reduction of 3368 last week, the stop loss followed up at 3350. Today, the 3295 short position conservative 3297 short stop loss 3302 targets below 3275 and 3270. If it falls below, it looks at 3262 and 3250 and 3243 and 3235 support.

Silver: 32.75 short stop loss today 32.95, target 32.45 and 32.2 and 31.9

Europe and the United States: After opening low this week, it fell back to 1.12600 short stop loss 1.12800, target below 1.11850, target below 1.11600 and 1.11350.

US crude oil: 60.5 long stop loss today 59.9, target Look at 61.5 and 62 and 62.5-63.

Nasdaq Index: Today's 20150 stop loss 20050, and the target is 20450 and 20550*20600.

The above content is all about "[XM Foreign Exchange Market Analysis]: Sino-US settlement of risk aversion and retreat, gold and silver continue to go high altitude". It was carefully xmmarkets.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here