Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--EUR/USD Forecast: Slides After Dovish ECB Rate Cut

- 【XM Market Review】--Silver Forecast: Plunges as Major Central Banks Flinch

- 【XM Market Analysis】--Weekly Forex Forecast – GBP/USD, EUR/USD, USD/JPY, AUD/USD

- 【XM Market Analysis】--NASDAQ 100 Forecast: Continues to Power Higher

- 【XM Market Analysis】--GBP/JPY Forecast: Gives Up Early Gains

market analysis

Is gold still continuing to correct this round, or has it bottomed out in the short term?

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Is this round of gold still continuing to correct, or has it bottomed out in the short term?" Hope it will be helpful to you! The original content is as follows:

Zheng's silver dot: Is gold still continuing to correct this round, or has it bottomed out in the short term?

Review yesterday's market trend:

The layout of the first three days of this week was very smooth. 3255, 3327, 3355 gave the band bullish many times, and the highest was lifted to the 3435 line. However, the process of holding the band is often very difficult, because it has been unilaterally rising all the way, and there will be sudden turnover corrections, and due to the amplification of the base, the retracement strength seems to be larger than expected; in the end, the band 3420 of 3355 has xmmarkets.cnpleted all harvests, while 3327 has been protected, and 3290 of 3255 has been protected, giving up a lot of profits; but the band that should be insisted on will still persist. As long as it cannot be protected, it will eventually accumulate unexpected room for growth. In the early stage, the bullish bottom positions of 2735, 2753, 3000 and other bands are still in the process, and they will insist on getting to the end of the year to see the final effect. Good; and yesterday was the most tragic day. It was full of big sun at 10 o'clock in the morning. It had already broken through the upper track of the previous day's 3360-3397 range, and it was out of the fluctuation. It was ready to exert force upward and retrace back to confirm support to follow the bullish. Whether it is short-term or band, it was finally ruthlessly washed out by a big wash. Of course, the two were not carried out simultaneously, because the entry point was consistent. Those who did short-term will not participate in the band, and those who did bands will not participate in the short-term increase. After the big wash, there will be more or less psychological concerns. The research report mentioned that 3360-3370 was under pressure and fluctuated for several hours after it was in place. It was suppressed and declined. After the support 3305 arrived, it also held back and did not take action. It wanted to wait until the long lower shadow line appeared before intervening in the bullish position. As a result, the signal was given before closing. The opening day was opened today.The market analysis and interpretation of today's market analysis:

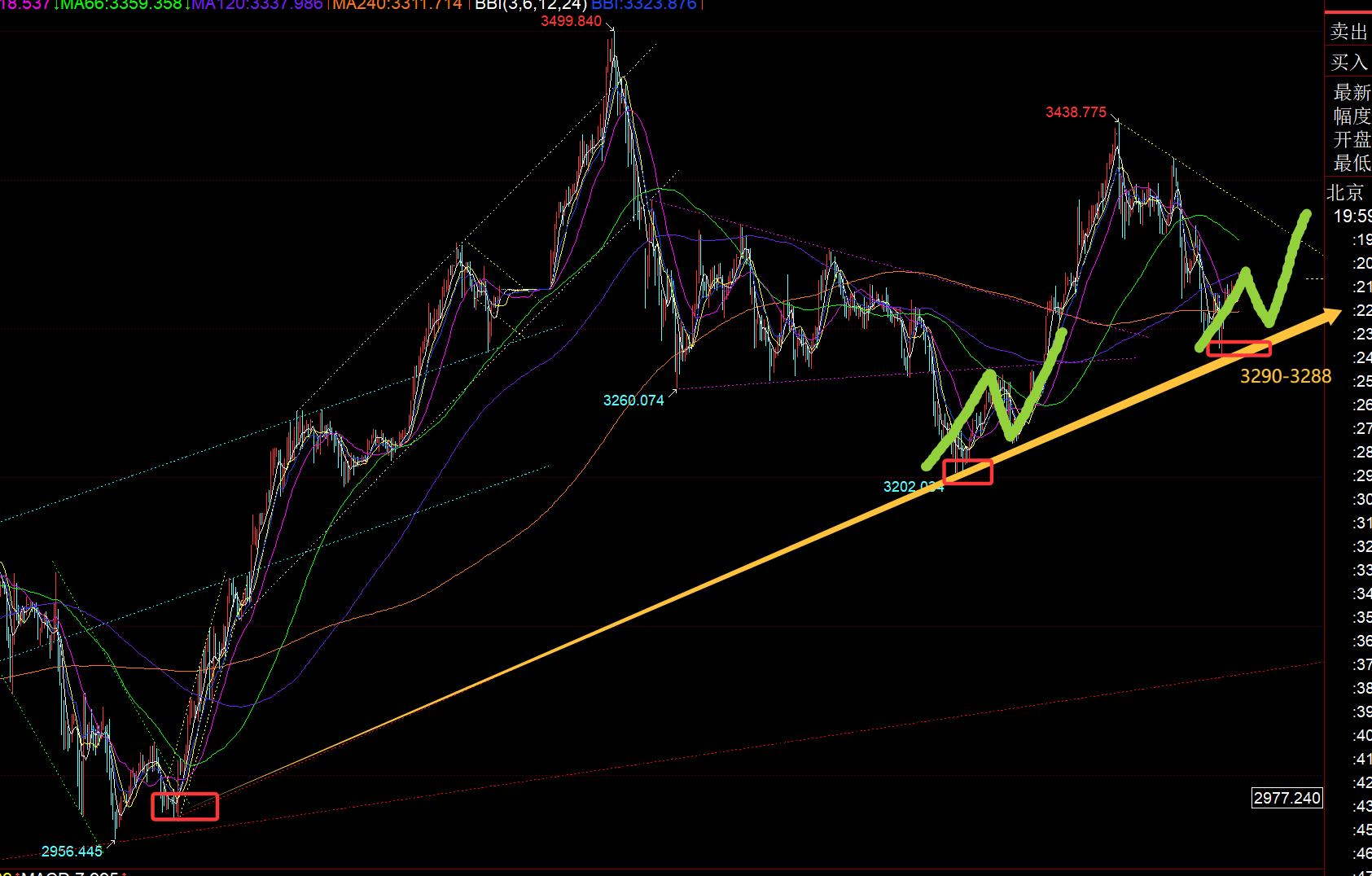

First, gold daily line level: two consecutive big positives rose sharply at the beginning of the week, and two consecutive big negatives fell sharply at the end of the week, and this week produced extreme bulls and bear kills. This kind of rapid change in a short period of time and too strong, and does not continue is relatively painful; but I still think it is just a correction under the bullish trend, and the trend cannot be changed. As long as the early low point of 3201 is not lost, it is still in the fifth wave of pulling up, but this period of pulling up may produce a small five wave, and the process is relatively bumpy; 3201 to 3438 is the first rising wave of the small five wave, and the 618 segmentation support 3292 line corresponds to the second wave (daily There is a piercing of 3292 and wash the market again), so today's closing line is more critical. It must close positive and still effectively stand on the middle track, so the third wave rise will only be possible next week; at this time, the short-term moving average is golden cross, and the price is not on the 5th moving average, and it is also diverged, and it is expected to close above the 5th day and return to normal performance; there is another situation, it may go similar to that in November and December last year, after the second high point is generated, it will expand the wide range for a period of time, and then finally make a strong attack; no matter how it goes, the correction is always correction, and sooner or later the trend will be again, refreshing the 3500 high point; at present, the low point within 3274 days is temporarily used as the short-term adjustment bottom, waiting for the continued efforts to stabilize the upward attack next week;

Second, Golden Hourline Level: Today's Asian session is another disgusting way to wash the market. First, pull 20 meters in a hurry to open, and confirm that the top and bottom support is 3310, rebound at 9 o'clock and close the positive. The two positives are wrapped around the yin and are ready to attack. As a result, turn down at 10 o'clock, pierce the trend support point 3280 on the chart, touching 3274 and then pull back to the day's high. As long as you are continuing the trend, no matter how long and short it will be washed away. Although the European session's anti-decline sideways trading above the Asian session's high point 3224, it is still easy to suppress immediately after rushing, and continuity is still a problem. This is related to the way of last Friday, the US session's last wave of short-sucking, and the second half of the night Stabilize, gradually push up strongly next week; from the perspective of pattern, 3274 may not be able to stand firm with one foot. If you can get another kick, the low position will be much more stable; just as 3290-3288 is to test the position of the trend support line again, which can form a "head and shoulder bottom" pattern, and the bottom is well organized. There is sufficient momentum to exert force upward; therefore, you don't plan to chase the rise now, and there may still be room for pulling up, but the continuity is too poor in the past two days. Try to wait for the relatively low position before trying to speculate. If it cannot be given tonight, and the daily positive is formed, then it will be too late to follow again next week, because once the strong trend is opened, you can follow any position;

Silver aspect: channelReverse pressure point 32.9, support 32, continue to oscillate;

Crude oil: From the above chart, the daily line continues to be positive, the daily line breaks through the middle track, the trend resistance line breaks, and the retracement confirms 60.4 to try to see the stabilization, which is also the middle track of the hourly line. After touching, look at the signal and observe more, the crude oil will easily fluctuate repeatedly;

The above are several points of the author's technical analysis. As a reference, it is also the summary of technical experience accumulated by the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and text and video interpretations. Friends who want to learn can xmmarkets.cnbine the actual trend. To xmmarkets.cnpare and refer to; those who recognize ideas can refer to operations, lead defense well, risk control first; those who do not recognize them should just be over; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmmarkets.cnments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Market Analysis]: Is this round of gold still continuing to correct, or has it bottomed out in the short term?", which was carefully xmmarkets.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here