Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--Gold Analysis: Awaiting Key Events

- 【XM Decision Analysis】--BTC/USD Forecast: Remains in a Massive Range

- 【XM Decision Analysis】--BTC/USD Forex Signal: Could Get Worse Before Getting Bet

- 【XM Decision Analysis】--GBP/USD Forex Signal: On the Verge of a Bearish Breakdow

- 【XM Decision Analysis】--NZD/USD Forecast: Limited Movement

market news

Extreme pulling the big negative line, gold and silver are oversold and putting in the range

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Extreme pulls the big negative line, and gold and silver are oversold to make the range". Hope it will be helpful to you! The original content is as follows:

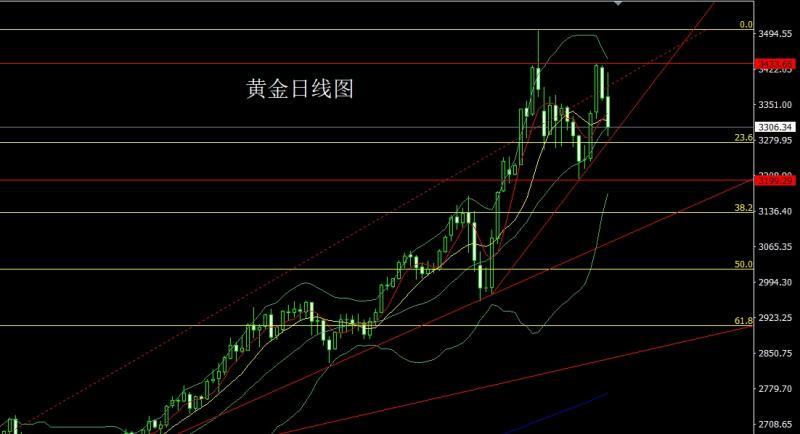

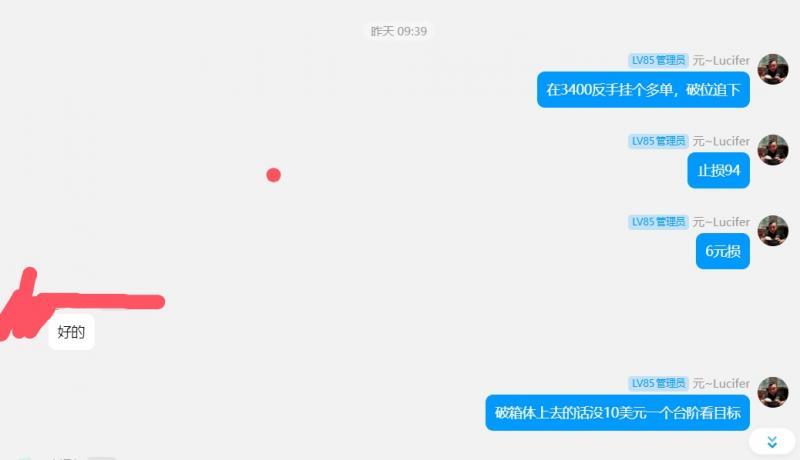

The gold market opened at 3366.9 yesterday and the market rose directly. The daily line reached the highest position of 3415. After the market started a fallback process. After the market fell below the range support, the market accelerated to fall. The daily line was at the lowest position of 3288.2 and then the market rose at the end of the trading session. The daily line finally closed at 3306. After the market closed with a large negative line with a long upper shadow line. After this pattern ended, the short position of 3368 in the US market yesterday, the stop loss followed up at 3365. After yesterday's oversold, the short position of 3350 was given today to conservative 3353 short stop loss 3357. The target below is 3310 and 3300. The low point below is 3288. The xmmarkets.cnpetition is yesterday for the low point. If it falls below, 3275 and 3250-3242.

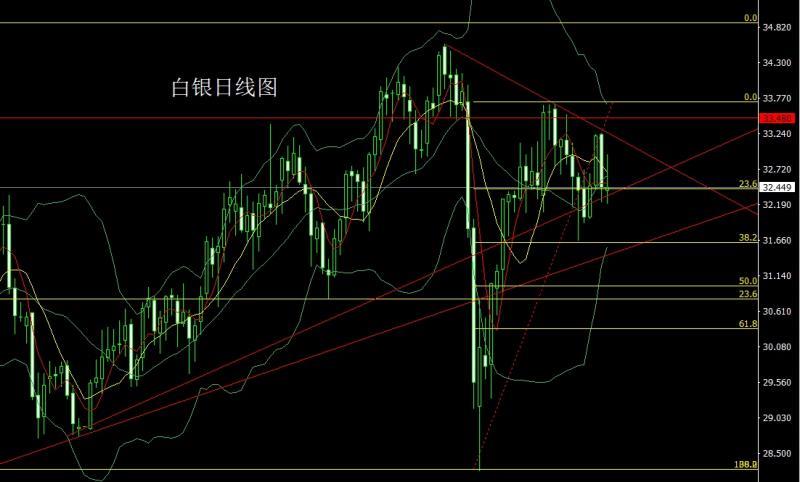

The silver market opened at 32.408 yesterday and then the market rose first. The daily line reached the highest position of 32.933 and then the market fell strongly. The daily line was at the lowest position of 32.206 and then the market pulled up. The daily line finally closed at 32.449. After the market closed with a shooting star with a very long upper shadow line, the stop loss followed by 32.8 yesterday, and the stop loss was 32.8 today, and the short stop loss was 32.8 today. The target below is 32.2 and 32 and 31.8.

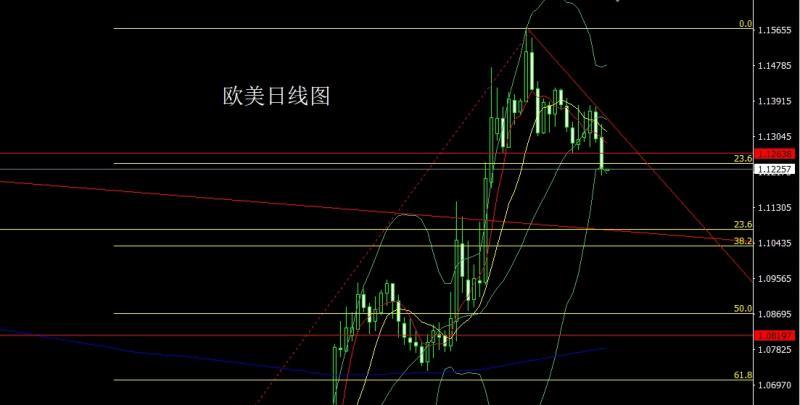

European and American markets opened at 1.13033 yesterday and the market first rose to 1.13362, and then the market fell strongly. The daily line was at the lowest point of 1.12109, and the market consolidated. The daily line finally closed at 1.12275, and the market closed with a large negative line with an upper shadow line longer than the lower shadow line. After this pattern ended, the daily line fell below the head, shoulders, and neck line. Today's retracement continued short. At the point, today's short stop loss of 1.12900 today, and the target below is 1.12100 and 1.11800 and 1.11500-1.11300.

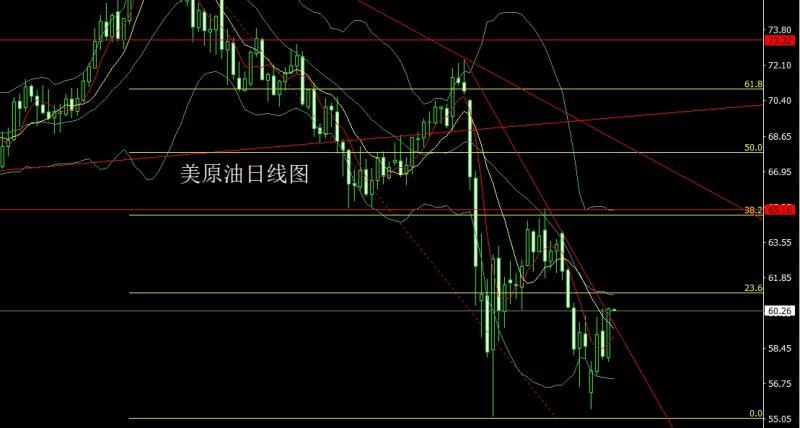

The US crude oil market opened at 57.97 yesterday and the market fell slightly. After giving the position of 57.8, the market fluctuated strongly. The daily line reached the highest position of 60.38 and then the market consolidated. The daily line finally closed at 60.37 and then closed with a basically saturated positive line. After this pattern ended, the 59-long stop loss was 58.4 today, the target was 60 and 60.5, and the break was 61 and 61.5-61.9 pressure.

Nasdaq index market opened at 19843.05 yesterday and the market fell back to the daily low of 19827.22. After the market rose strongly. The daily line reached the highest level of 20246.77. After the market consolidated, the daily line finally closed at 20067.87. Then the market closed with a medium-positive line with a long upper shadow line. After this pattern ended, today's short stop loss of 20200 20320. The target below is 20000 and 19900 and 19800, and the falling below is 19650 and 19500.

The fundamentals, the fundamental tariff issue was still the focus yesterday, and the UK and the United States reached a trade agreement. The 10% benchmark tariff on the UK will be retained, market access between the two sides will be expanded, tariffs on steel and aluminum will be cancelled, tariffs on US agricultural products will be imposed, and stepped tariffs on British automobile imports will be imposed. U.S. Trade Representative: Enforcement actions may be required for import services. US President: Britain agrees to a $10 billion Boeing aircraft procurement agreement. US Secretary of xmmarkets.cnmerce: Focus on the next big country and hope to reach a trade agreement with a big country from Asia. If negotiations are not going well, the EU plans to impose additional tariffs on U.S. products worth 95 billion euros, and the US president's speech showed yesterday. Calling Powell "Mr. Taichi" again is a fool. The call for "It's best to buy stocks now" was directly issued in the press conference. It is reported that the current US president seeks to increase taxes on wealthy people with annual income of more than $2.5 million to 39.6%. After the data, the US index was supported and the gold and silver market fell. Today's fundamentals are mainly focused on the FOMC permanent vote xmmarkets.cnmittee at 18:15 and New York Fed Chairman Williams at 20Keynote speech was delivered at the 25th Reykjavik Economic Conference. Watch the 2025 FOMC voter and Chicago Fed Chairman Goulsby delivered a welcome speech and opening speech at an event at the Federal Reserve at 22:00 in the evening. Then watch the FOMC Permanent Voting xmmarkets.cnmittee at 23:30 and New York Fed Chairman Williams delivered a speech at the Hoover Monetary Policy Conference (through pre-recorded video).

In terms of operation, gold: Yesterday, the short position of 3368 in the US market was reduced and the stop loss was followed by 3365. After yesterday's oversold, the short position was given 3350 and conservative 3353 short stop loss 3357. The target below is 3310 and 3300. The low point below is 3288. The low point of the fall is 3275 and 3250-3242.

Silver: The stop loss was followed by 32.8 yesterday after the short position reduction of 32.8, today the short stop loss was 32.8, and the target below was 32.2 and 32 and 31.8.

Europe and the United States: 1.12700 short stop loss today 1.12900, the target below was 1.12100 and 1.11800 and 1.11500-1.11300.

U.S. crude oil: 59 long stop loss today 58.4, the target target is 60 and 60.5, and the pressure of breaking the position is 61 and 61.5-61.9.

Nasdaq Index: Today is 20200 short stop loss 20320, the target below is 20000 and 19900 and 19800, and the target below is 19650 and 19500.

Yesterday, 3395 short, 3384 left, 3400 long, 3410 left, 3368 left, 3368 left, 3368 left, 3368 left in the evening

The above content is all about "[XM Foreign Exchange Platform]: Extreme pulls the big negative line, gold and silver are oversold to make the range". It was carefully xmmarkets.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here