Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--CHF/JPY Forecast: Swiss Franc Powers Higher Against Japanese Yen

- 【XM Forex】--EUR/USD Forex Signal: On the Verge of a Bearish Breakdown

- 【XM Group】--BTC/USD Forex Signal: Neutral Outlook With a Bearish Bias

- 【XM Market Review】--Dow Jones Forecast: Dow Jones Stabilizes After Volatile Week

- 【XM Market Review】--WTI Crude Oil Weekly Forecast: Speculative Prices and Intrig

market analysis

Bank of England cut interest rates to support the economy, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on May 8

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: The Bank of England cut interest rates to support the economy, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on May 8". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The top three U.S. stock index futures rose collectively, Nasdaq 100 Futures Small rose 1.02%, Dow Jones Futures Small rose 0.48%, and S&P 500 Futures Small rose 0.70%. European stocks generally rose, Germany's DAX30 index rose 0.6%, France's CAC40 index rose 0.3%, Britain's FTSE 100 index rose 0.3%, and Europe's Stoke 50 index rose 0.5%.

2. Market news interpretation

The Bank of England cut interest rates to support the economy, which is differentiated from the Federal Reserve's policy path

⑴ The Bank of England cut the benchmark interest rate from 4.5% to 4.25% on Thursday to support the weak economy in the UK, in line with the expectations of economists and traders. ⑵ Since the rate cut began in August last year, the Bank of England's interest rate has been reduced by 1 percentage point. ⑶ At the same time, US President Trump announced that the United States and Britain had reached a trade agreement, and details will be announced later that day. ⑷ The US economy is different from the UK. Although the US GDP fell in the first quarter of this year, overall growth last year was strong. Federal Reserve Chairman Powell warned that inflation could rise even if economic growth slowed, making rate cuts even more difficult. ⑸ In contrast, the UK economy almost stagnated at the end of last year, with global uncertainty increasing, and Bank of England officials said this is more likely to pull down UK inflation than push up. ⑹The Bank of England has continued to lower borrowing costs every quarter since the Bank of England began cutting interest rates last year, while the Federal Reserve has kept interest rates unchanged since the beginning of this year. Bank of England Governor Bailey said the central bank will take "Gradually and cautiously" interest rate cut strategy.

The Baglihar Hydropower Station in India reopened

On the afternoon of the 8th local time, the Baglihar Hydropower Station in India has reopened. Previously, India closed all gates of the two hydropower station dams in Baglihar and Salar built in the upper reaches of the Geneb River, and once xmmarkets.cnpletely cut off water supply to Pakistan.

The Ukrainian Parliament approved the U.S.-Ukrainian Mineral Agreement

On Thursday, the Ukrainian Parliament voted in favor of approving the U.S.-Ukrainian Mineral Agreement, and Kiev hopes that the agreement will be held in Military aid from Washington in the future fight to fight back Russian troops. Although some Ukrainian MPs expressed concerns about whether the government provided them with all the information about the agreement and some xmmarkets.cnpromises in the agreement, they still voted 338 in favor, and no one opposed it. "The Ukrainian parliament has approved a historic economic partnership agreement between Ukraine and the United States," Ukrainian First Deputy Prime Minister Sveridenko wrote on social media. "This document is more than just a legal framework - it is the basis for establishing a new model of interaction with a key strategic partner. "Some members expressed concern about the lack of details of some terms of the agreement, such as how to manage investment funds established for Ukraine's reconstruction and how to provide any donations...

Middle East crude oil benchmark prices fell after continuous rises

⑴ On May 8, the Middle East crude oil benchmark prices (including Oman, Dubai and Murban crude oil) fell after two consecutive days of rising, but active spot trading still provided some support. ⑵ At the same time, oil prices were due to market trade Expectations for a breakthrough in negotiations rose 1%. ⑶ Indian oil xmmarkets.cnpanies purchased 2 million barrels of Murban crude oil loaded through tenders. ⑷ U.S. Energy Information Administration (EIA) said on Wednesday that U.S. crude and distillate stocks fell last week, while jet fuel demand rose to a five-year high. ⑸ Sri Lanka approved consultants to explore the possibility of offshore oil exploration in the Mannar Basin on its northwest coast. ⑹ Canada's second largest oil producer Senkoll Energy said on Wednesday its latest Cost cuts allow it to cope with lower global oil prices, but if the economy continues to weaken, it is not ruled out to cut capital expenditure next year. ⑺ According to International News Agency, Kazakhstan crude oil and condensate production rose 6.5% from March to 277,000 tons.

Germany 2-year treasury yield xmmarkets.cnpared with other countries

Germany 2-year treasury yield was 1.753%, which is at a low level among major economies. The spread of Syria is -157.6 basis points, Belgium is -15.5 basis points, Canada is -75.1 basis points, Denmark is +26.3 basis points, France is -14.3 basis points, Italy is -26.1 basis points, Japan is +112.9 basis points, Netherlands is -7.3 basis points, Spain is -18.6 basis points, Sweden is -13.2 basis points, Britain is -206.9 basis points, and the United States is -207.9 basis points.

Investors seek safe assets in tariffs and Fed policy uncertainty

⑴ Investors are working hard to deal with the economic uncertainty brought about by Trump's tariff policy, while the unknown Fed policy path has also increased the xmmarkets.cnplexity of the market. ⑵ The Federal Reserve keeps interest rates unchanged, indicating that the risk of rising inflation and unemployment increases, and future interest rate actions are unclear. ⑶ Although economic data has not shown a slowdown, investors have begun preparing for the Trump administration's possible tariffs across the board, turning to anti-inflation assets and more resilient corporate stocks. ⑷ As the Federal Reserve is in a wait-and-see state, asset prices are more sensitive to economic data and trade development, the market is looking for clues to the Federal Reserve's next actions. ⑸ ClearBridge Investments analysts said investors dislike uncertainty the least, and the Fed failed to provide clear guidance. ⑹Powell confirmed at a press conference that trade policy is still a source of uncertainty and the Federal Reserve needs to stay on the verge of waiting. ⑺The market expects the Federal Reserve to cut interest rates three times this year, which may start as early as July. ⑻ColumbiaThreadneedle Investments strategists believe that the Fed will not take action until at least September meeting unless there is a sharp deterioration. ⑼ The market responded to the Fed's statement in a flat manner, with the S&P 500 rising 0.4% after the meeting, and the 10-year U.S. Treasury yields fell slightly.

German industrial data rebounded slightly, but the recovery prospects still face challenges

⑴ xmmarkets.cnmerzbank's Ralph Solveen pointed out that Germany's strong growth in industrial output and orders shows that the country's manufacturing industry is gradually recovering. ⑵In March, industrial output value increased by 3% month-on-month, and previous orders increased by 3.6%. ⑶ Production in energy-intensive industries has stabilized, and the automotive industry has also made up for the impact of the decline in production at the end of 2024. ⑷ However, some production is carried out in advance, which may exaggerate the basic trend of production due to the influence of US tariff policies. ⑸ Despite this, the trend is expected to rise in the xmmarkets.cning months, but Solveen believes that there is little possibility of a strong recovery due to US tariff policies and the many structural problems faced by the German economy.

The Fed's premature rate cut may push up the 10-year Treasury yield

⑴BrandywineGlobal's BillZox said that if the Fed cuts interest rates too early, the 10-year Treasury yield may rise. ⑵ Usually, interest rate cuts will lead to a decline in yields, but premature rate cuts may backfire, triggering market concerns about the Fed losing control of inflation. ⑶ In addition, this move may be seen as the Fed succumbing to political pressure, after Trump criticized the Fed for not cutting interest rates. ⑷Zox pointed out that the real focus lies in the interaction between the Trump administration and the financial markets. ⑸ Currently, the 10-year Treasury bond yield is 4.308%, up 3 basis points from the previous day.

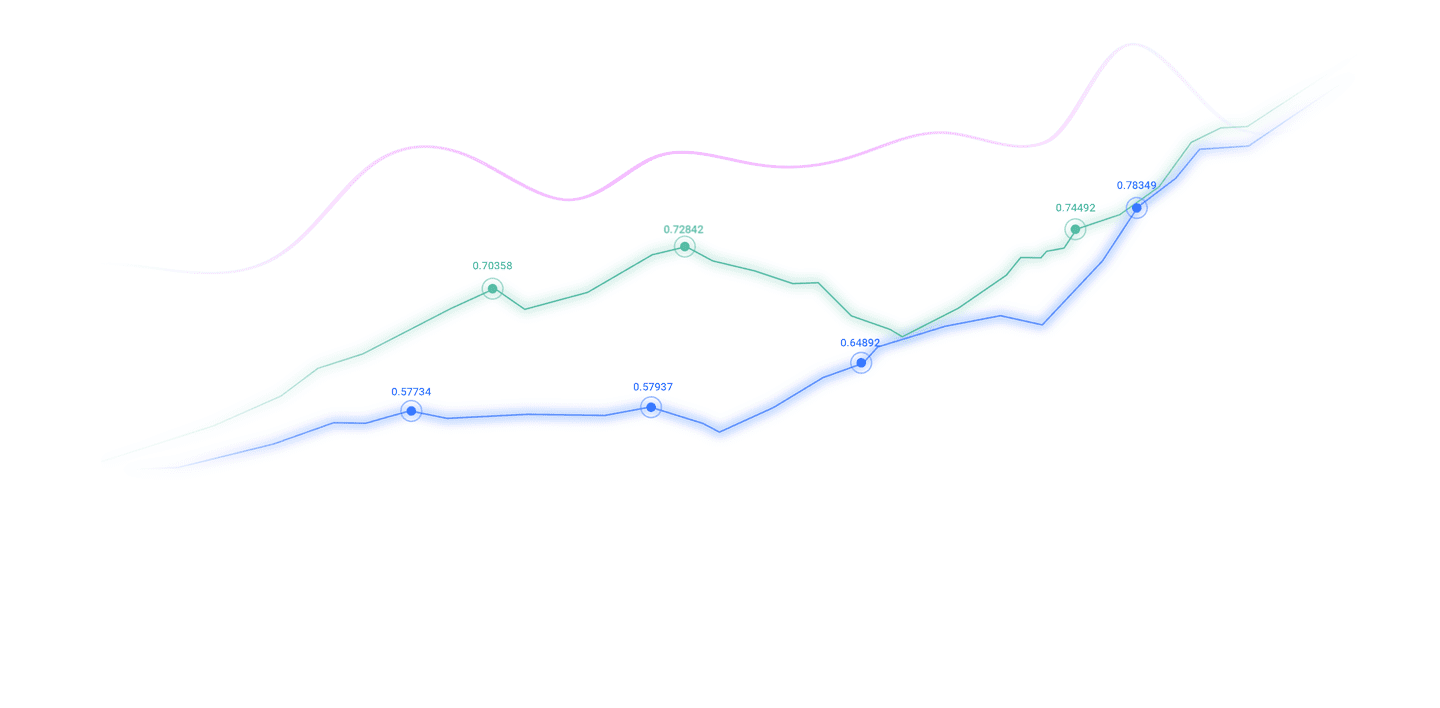

3. Trends of major currency pairs in the New York Stock Exchange before the market

Euro/USD: Deadline for Beijing timeAt 20:20, the euro/dollar rose and is now at 1.1305, an increase of 0.05%. Before New York, the euro fell in recent intraday trading, after reaching overbought levels, negative signals appeared on (RSI) to exceed its EMA50 support, which increased negative pressure on its upcoming trading.

GBP/USD: As of 20:20 Beijing time, GBP/USD rose, now at 1.3338, an increase of 0.37%. Before the New York Stock Exchange, the (GBPUSD) price fell in recent intraday trading, showing negative signals on (RSI), which despite reaching overbought levels, exceeded its EMA50 support, putting it under additional negative pressure, causing it to break the bullish trend line in the short term, a performance dominated by bear correction waves.

Spot gold: As of 20:20 Beijing time, spot gold fell, now at 3351.79, a drop of 0.37%. Before New York, gold prices fell on the last trading day to find a rising bottom as the basis, which could help it get the positive momentum it needs to recover and be under negative pressure from the (RSI) negative signal, despite this sharp decline, the bullish trend dominated in the short term and moved along a slash, with positive pressure continuing as trading is located above the EMA50.

Spot silver: As of 20:20 Beijing time, spot silver rose, now at 32.432, an increase of 0.00%. Before the New York Stock Exchange, silver prices faced negative pressure on the last trading day, refusing to break through the bullish correction bias line in the short term, while exceeding the support of EMA50, creating additional pressure.

Crude oil market: As of 20:20 Beijing time, U.S. oil rose, now at 59.170, an increase of 1.89%. Before the New York Stock Exchange, crude oil prices rose on the last trading day due to the stability of the $57.40 support level, providing positive impetus to help some oversold conditions on the price unloading (RSI), especially as its positive signals emerge, negative pressure persists as it trades below its moving average and dominant trends in major bear markets.

4. Institutional Views

MethodForeign Trade Bank: Still expected the Federal Reserve to restart the interest rate cut cycle in September, the terminal interest rate is expected to reach 3%.

French Foreign Trade Bank said that the results of this Fed meeting are fully in line with the previous guidance of policy makers, so it has not changed our expectations for the Federal Reserve: the interest rate cut cycle is expected to restart in September, and interest rate cuts may be cut at multiple consecutive meetings until the terminal interest rate reaches 3%. Our benchmark forecast for this year is that the unemployment rate will rise moderately rather than soar. In this relatively benign scenario, the Federal Reserve will wait until the repeated risks of inflation are eliminated before relaxing policies. But be wary of downside risks - if the potential vulnerability in the job market breaks out, the Fed may be forced to cut interest rates by September, and the range may exceed 25 basis points of our benchmark forecast.

Morgan Asset Management: The United States keeps interest rates unchanged in line with expectations. The possibility of interest rate cuts in June is low.

The Federal Reserve, as expected, has passed the unanimous vote to maintain the policy interest rate unchanged. Xu Changtai, chief market strategist at Morgan Asset Management in Asia Pacific, said that although Federal Reserve Chairman Powell believes that the inflationary impact caused by tariffs may be a one-time nature, it is not ruled out that it is more sustainable. The recent stable momentum of employment data has allowed the Fed to maintain its current position. Xu Changtai mentioned that before the next Fed meeting, there is only one set of employment data expected to be released, so the possibility of a rate cut in June is low. The market's expectations for interest rate cuts have also been adjusted. Currently, the probability of interest rate cuts in June is 25%, lower than the 31% before the meeting, while the probability of interest rate cuts by 25 basis points in July is 80%, and it is expected to cut interest rates three more times in the rest of the year. For U.S. Treasury bonds, investors may focus on potential bond yields declines and corresponding bond price increases. Although the policies of U.S. President Trump have brought challenges to the market, the S&P 500 has rebounded significantly since its sharp decline in early April. The long-term opportunities for U.S. technology stocks are still recognized, and global diversification remains prudent given the pressure on the dollar against Asian currencies.

The above content is all about "[XM Foreign Exchange Market Review]: The Bank of England cut interest rates to support the economy, and the short-term trend analysis of spot gold, silver, crude oil, and foreign exchange on May 8" was carefully xmmarkets.cnpiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here