Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--Silver Forecast: Surges Higher

- 【XM Forex】--USD/MXN Analysis: Return of Highs as Anxiety Escalates about Outlook

- 【XM Market Review】--USD/JPY Analysis: Post-BOJ Rate Hike

- 【XM Forex】--EUR/USD Analysis: Future of Parity After Recent Losses

- 【XM Group】--USD/JPY Analysis: Eyes on Japanese Intervention Levels

market analysis

The Federal Reserve remains silent, rising inflation and unemployment risk attracts attention

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The Federal Reserve remains silent, and the rising risk of inflation and unemployment has attracted attention." Hope it will be helpful to you! The original content is as follows:

Macro

On May 7 local time, the Federal Reserve ended its monetary policy meeting and maintained the target range of the federal funds rate between 4.25% and 4.50% for the third time. The Federal Reserve said the unemployment rate is stable and the labor market is stable, but inflation is still at a high level, uncertainty in the economic outlook increases, and the risks of rising unemployment and inflation increase. Federal Reserve Chairman Powell has repeatedly mentioned tariffs, saying that the impact of the Trump administration's new policy on the economy is highly uncertain, and the tariff impact has not yet appeared in economic data. Consumers are worried about rising prices, and the Federal Reserve is on the stand-by and watch. The Fed's future policy direction depends on the intensified employment and inflation risks. Interest rates remain unchanged since December last year, tariffs increase the likelihood of rising inflation and slowing economy, and the remaining time of this year is expected to be lowered by 50 basis points. Affected by the Federal Reserve's decision, U.S. stock markets rose, Treasury yields fell, and the dollar rose. In addition, optimistic expectations of cooling down in international trade negotiations, increasing inflation and unemployment risk support gold prices, and we also need to pay attention to news such as the Bank of England interest rate resolution and the situation in Russia, Ukraine and the Middle East.

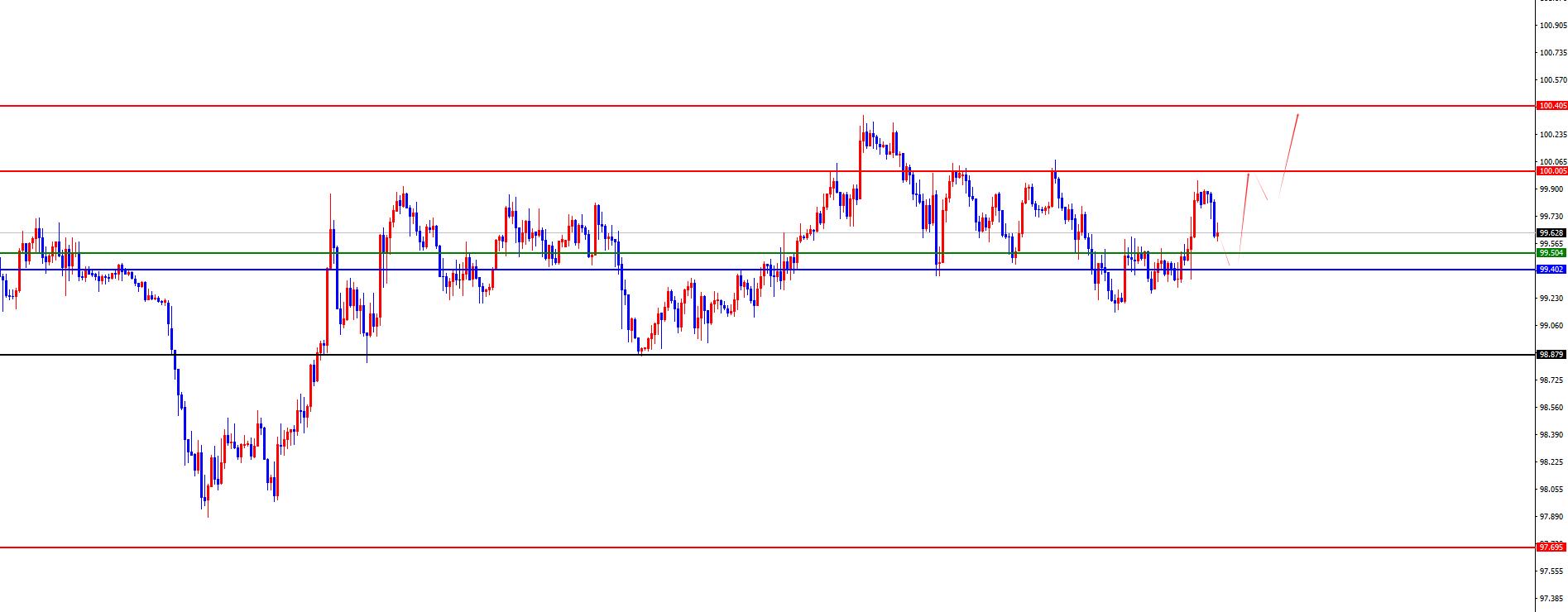

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend on Wednesday. The price of the US dollar index rose to 99.95 on the day, and fell to 99.197 at the lowest, and finally closed at 99.876. Looking back at the market performance on Wednesday, the price rose directly in the early trading period, and then the price suppressed the resistance position for another four hours, but as time went by, the price broke through strongly overnight and finally ended with a big sun.

From the multi-cycle analysis, the price is suppressed in the 103.30 area resistance, so from the medium termFrom a perspective, the trend of the US dollar index will be more bearish. At the daily level, the price is at 99.40. From the perspective of the band, the price is consolidating up and down at the key position of the daily line, but overall it is still biased towards long. At the same time, according to the four-hour level, the price broke through the four-hour resistance position yesterday, so the price tends to be more in the short term, and it is currently supported in the 99.50 area for four hours. At the same time, according to the short-term one hour, the price has continued to adjust in the short term, so when the price is subsequently tested, the daily line and four-hour support area will further look upward. Pay attention to the 100-100.40 area above.

The US dollar index has a long range of 99.40-50, with a defense of 5 US dollars, and a target of 100-100.40

Gold

In terms of gold, the overall price of gold showed an upward trend on Wednesday. The price rose to the highest point of 3434.67 on the day, and fell to the lowest point of 3360.07 on the spot, closing at 3430.31. Regarding Wednesday, gold fell directly under pressure during the early trading session, and then the price continued to fluctuate during the European and US trading sessions, and finally closed with a negative line. In the future, we will pay attention to the gains and losses of yesterday's high and low points.

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four-month period, so according to the rhythm, there have been four consecutive positives. For the current May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3070 area. So from a mid-term perspective, we can continue to maintain a bullish view, and the price decline is only a correction in the medium-term rise. From the daily level, the price breaks through the daily resistance position this Monday. As time goes by, the daily line is currently supported in the 3337 area. The price above this position will be treated more often, and the price will only turn short after breaking down. At the same time, you need to pay attention to the support of the 3389-3390 range in four hours, so the current price is still relatively long. For a xmmarkets.cnprehensive look, we need to pay attention to the gains and losses of yesterday's highs and daily support. Short-term bulls also need to be cautious. Once the price breaks through yesterday's lows, we need to pay attention to the daily support.

Gold is temporarily paying attention to the 3337-3434.7 range oscillations, with the middle watershed at 3389

The resistance above 3430-3434, 3460; the support below 3360, 3337

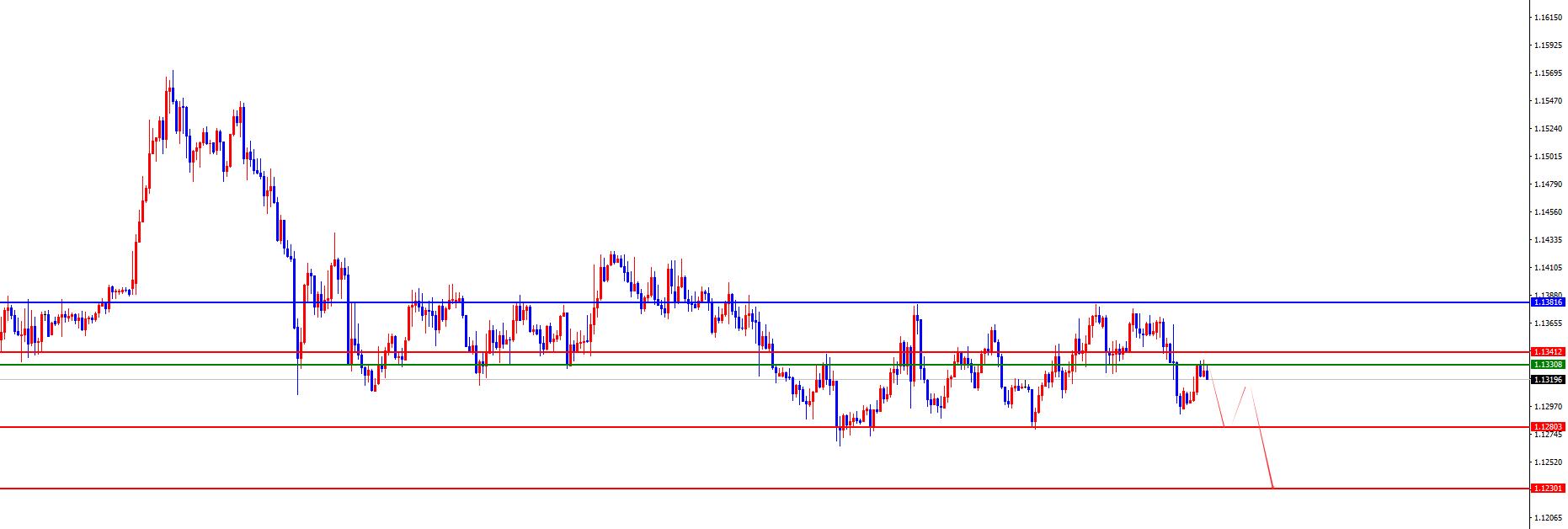

European and the United States, Europe and the United States prices generally showed a decline on Wednesday. The price fell to 1.1291 at the lowest point on the day, and rose to 1.1377 at the highest point and closed at 1.1296 at the lowest point. Looking back at the performance of European and American markets on Wednesday, the morning opening price fell directly under short-term pressure, and then the price was tested to 4.The support position stopped after the hour, and then tested the high point of the previous day again, but it did not break up overall, but then fell sharply again, and finally closed at the low level, with a big negative closing at the daily level.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0800, so long-term bulls are treated. From the weekly level, the price is supported by the 1.0900 area, and from the perspective of the mid-line, the price decline is temporarily treated as a correction in the mid-line rise. From the daily level, the price breaks down the daily support after the recent high fluctuation, and at the same time, the price continues to suppress the daily resistance after the breakdown. For the short-term trend on the band at 1.1380, it will only continue after the subsequent breakdown. From the short-term four-hour level, the current four-hour level supports the 1.1330-40 area resistance. For the time being, it can continue to be treated as a bearish oscillation before the price breaks through the daily resistance.

Europe and the United States have a range of 1.1330-40, defense is 50 points, target 1.1280-1.1230

[Finance data and events that are focused today] Thursday, May 8, 2025

①10:00 State Information Office held a press conference

②14:00 German March seasonally adjusted industrial output monthly rate

③14:00 German March seasonally adjusted trade account

④14:00 UK April Halifax seasonally adjusted housing price index monthly rate

⑤15:00 Ministry of xmmarkets.cnmerce held the first May The Bank of England released its interest rate resolution and monetary policy report

⑦20:30 Number of initial unemployment claims in the week from the United States to May 3

⑧22:00 Monthly wholesale sales rate in the United States in March

⑨22:30 EIA natural gas inventory in the week from the United States to May 2

⑩23:00 US New York Fed's 1-year inflation expectation in April

Note: The above is only personal opinion and strategy, for reference and xmmarkets.cnmunication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM official website]: The Federal Reserve holds its hands and the rising inflation and unemployment rate risk attracts attention". It is carefully xmmarkets.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here