Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--USD/MYR Forecast: US Dollar Stalls Against Malaysian Ringg

- 【XM Market Analysis】--USD/CAD Forecast: Pushes Higher Amid Dollar Strength

- 【XM Market Review】--EUR/USD Forecast: Rallies Again

- 【XM Market Review】--EUR/USD Forex Signal: Bullish Consolidation Basing Off $1.04

- 【XM Decision Analysis】--USD/PHP Forecast: US Dollar Powers Higher Against Philip

market news

Fed policy shift is imminent, global markets are waiting for breath

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Forex will bring you "[XM Official Website]: The Fed's policy is about to move, and the global market is waiting for breath." Hope it will be helpful to you! The original content is as follows:

Macro

The current global economic and political situation is xmmarkets.cnplex and has a far-reaching impact on the market and international relations. Economically, the United States faces multiple pressures. The 2-year treasury bond yield has declined, and the market is worried about the impact of the trade war due to the trade deficit and pessimistic outlook on enterprises. Traders expect the Federal Reserve to cut interest rates three times this year, the first time in September, but investors are still worried that policies are not loose and the market outlook is unclear. There are new progress in international economic and trade cooperation. India and Britain have reached a trade agreement, and Britain and the United States will also sign an agreement. Some British goods can be exempted from Trump's tariffs. In the energy market, OPEC+ increased production beyond expectations, causing oil prices to fall, Saudi Arabia warned the surplus member states that Kazakhstan considered fulfilling its contract. In the political field, Ukraine approved the draft mineral agreement with the United States, Oman reached a freedom of navigation agreement with the United States and Yemen, and the British government insisted on reducing welfare policies. In terms of the future market, the market is concerned about the Federal Reserve's policy decisions, and it is expected that the interest rate will remain unchanged but there will be variables in the future. At the same time, the conflicts and frictions between Israel and the Houthi forces and India and Pakistan have made the geopolitical situation tense, and investors need to pay close attention to the impact of these factors on the market.

Dollar Index

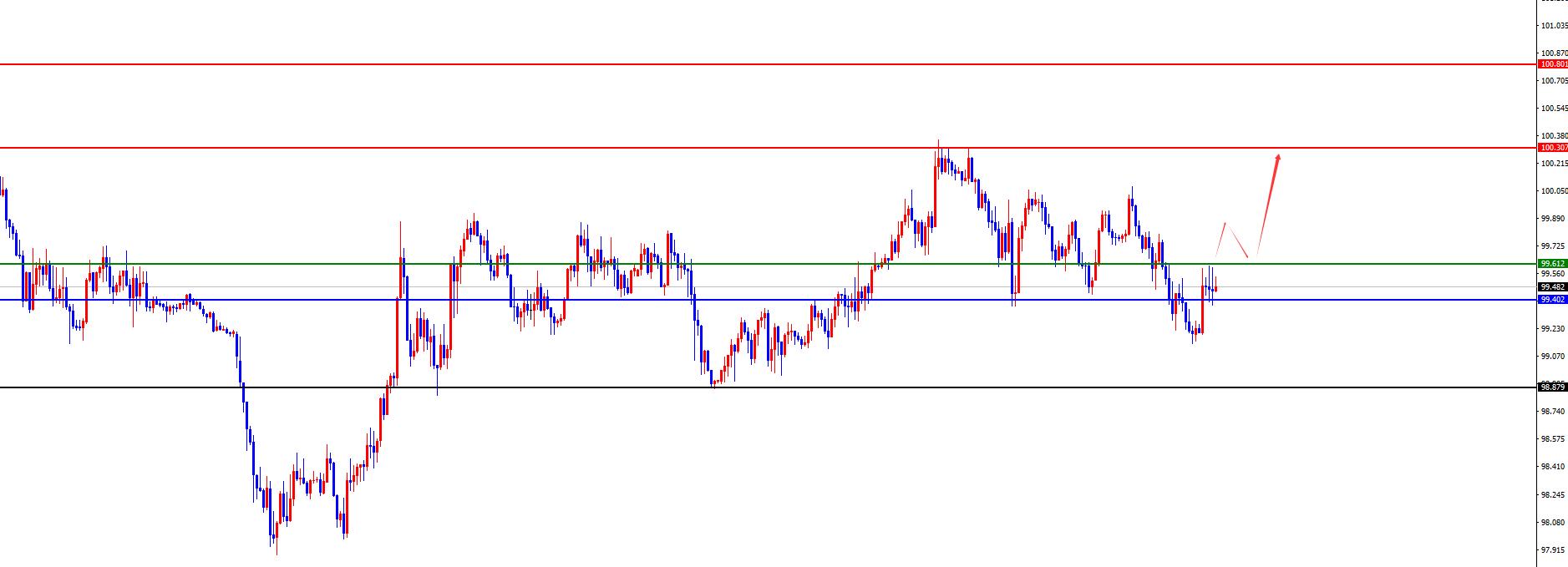

In terms of the performance of the US dollar index, the US dollar index showed a downward trend on Tuesday. The price of the US dollar index rose to 100.077 on the day, and fell to 99.143 at the lowest, and finally closed at 99.239. Looking back at the market performance on Monday, the price rose in the early trading period, but the continuity was poor afterwards, and the subsequent price continued to be under pressure and fell. After the US market, the price broke the daily support position. At the same time, the 99.60 position above is the key resistance. It is key to pay attention to whether the price can stop rising in the future.

From a multi-cycle analysis, the price is suppressed in the 103.30 area resistance at the weekly level, so from a medium-term perspective, the US dollar refers toThe trend of the number will be more bearish. At the daily level, the price is at 99.40. From the perspective of the band, the price is consolidating up and down at the key position of the daily line. In the future, you need to pay attention to the support of the 98.90 platform below. Looking at the 99.60 area resistance in the short term, the price is currently running below the key position in the four-hour period, so be cautious before the upward breakthrough. After the price breaks further, pay attention to further upward. Overall, the US dollar index is currently fluctuating at a low level. We will pay attention to the gains and losses of four-hour resistance and the support of 98.90 platform. The price will only break up the four-hour resistance again and then fall back and set aside for a long time. Otherwise, we will pay attention to the support of 98.90 platform for the time being.

The US index focused on the gains and losses of 99.60

Gold

In terms of gold, the gold price overall showed an upward trend on Tuesday. The price rose to 3434.61 on the day, fell to 3323.14 on the lowest, and closed at 3430.31 on the market. Regarding Tuesday's price of gold rose further on the morning market based on daily support, and then adjusted after testing the high point to retreat to 618 for the first time in the morning, but then made another move to rise and break through. Finally, the day closed at a high level, and the daily line ended with a big positive. In the future, we need to pay attention to the daily line and the four-hour support range to look at the rise. Only after the subsequent break will we further look at the pressure.

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four-month period, so according to the rhythm, there have been four consecutive positives. For the current May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3070 area. So from a mid-term perspective, we can continue to maintain a bullish view, and the price decline is only a correction in the medium-term rise. From the daily level, the current price resistance is in the 3332 area. This position is a key watershed in the band trend. Above this position, the overall price tends to be bulls in the band. At the same time, for the short-term four-hour price support in the 3350 area, the price has continued to operate above the four-hour support in recent days. The short-term price has a rapid retracement in the early trading session. We will continue to pay attention to the four-hour support in the future. If we do not break the daily support, we will temporarily treat it. However, once we break the daily support, we need to pay attention to further retracement. After all, we need to pay attention to risks in May at present.

Gold focuses on the 3340-3350 range, and maintains long if it does not break, and turn short in time after breaking down

Europe and the United States

Europe and the United States, prices in Europe and the United States generally showed an upward trend on Tuesday. The price fell to 1.1279 on the day and rose to 1.1380 on the spot and closed at 1.1368 on the spot. Review of the performance of European and American markets on Tuesday, morningThe opening price first continued to fall in the short term, then rose again and tested the daily resistance position. Finally, the closing was near the high level, and the daily positive ended.

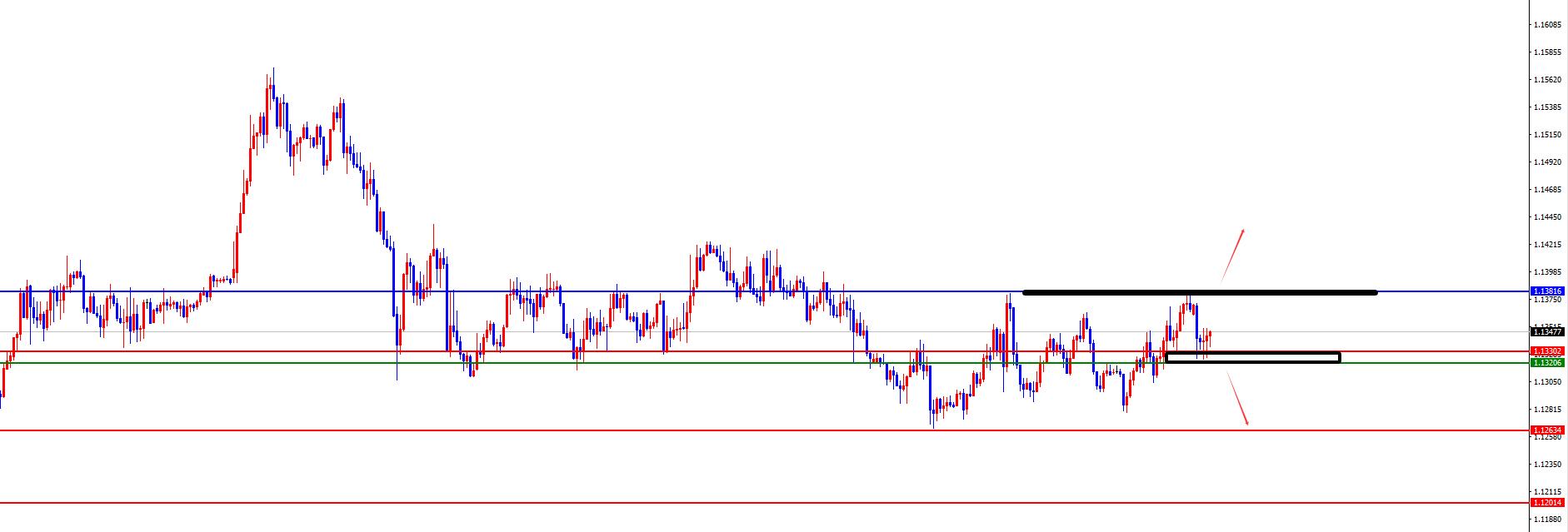

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0800, so long-term bulls are treated. From the weekly level, the price is supported by the 1.0900 area, and from the perspective of the mid-line, the price decline is temporarily treated as a correction in the mid-line rise. From the daily level, the price breaks down the daily support after the recent high fluctuation, and at the same time, the price continues to suppress the daily resistance after the breakdown. For the short-term trend on the band at 1.1380, it will only continue after the subsequent breakdown. From the short-term four-hour level, the current four-hour level is supported in the 1.1320-30 area. Since the price is consolidating up and down at the key four-hour position, we will continue to pay attention to the daily resistance gains and losses in the future.

Europe and the United States pay attention to the breaking range of 1.1320-1.1380, and follow after breaking

[Finance data and events that are focused today] Wednesday, May 7, 2025

①To be determined China's April foreign exchange reserves

②09:00 The State Council Information Office held a press conference

③14:45 France March trade account

④17:00 Eurozone March retail sales monthly rate

⑤22:30 EI in the week from the United States to May 2 A crude oil inventories

⑥22:30 EIA Cushing crude oil inventories in the week from the United States to May 2

⑦22:30 EIA strategic oil reserve inventories in the week from the United States to May 2

⑧The next day, the Federal Reserve FOMC announced the interest rate resolution

⑨The next day, the Federal Reserve Chairman Powell held a press conference

Note: The above is only personal opinions and strategies, for review and exchange only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM official website]: The Fed policy is about to move, and the global market is waiting for breath". It was carefully xmmarkets.cnpiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here