Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--AUD/USD Forecast: Eyes 0.62 Support

- 【XM Market Review】--Dax Forecast: Continues to See Buyers on Each Dip

- 【XM Decision Analysis】--GBP/JPY Forecast: Struggles Amid Central Bank Divergence

- 【XM Market Review】--EUR/GBP Forex Signal: Weakens Further

- 【XM Market Review】--USD/CHF Forecast: Pulls Back to Key Support

market analysis

The dollar index fluctuates slightly, focusing on the Fed meeting

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The US dollar index fluctuates slightly, focusing on the Federal Reserve meeting." Hope it will be helpful to you! The original content is as follows:

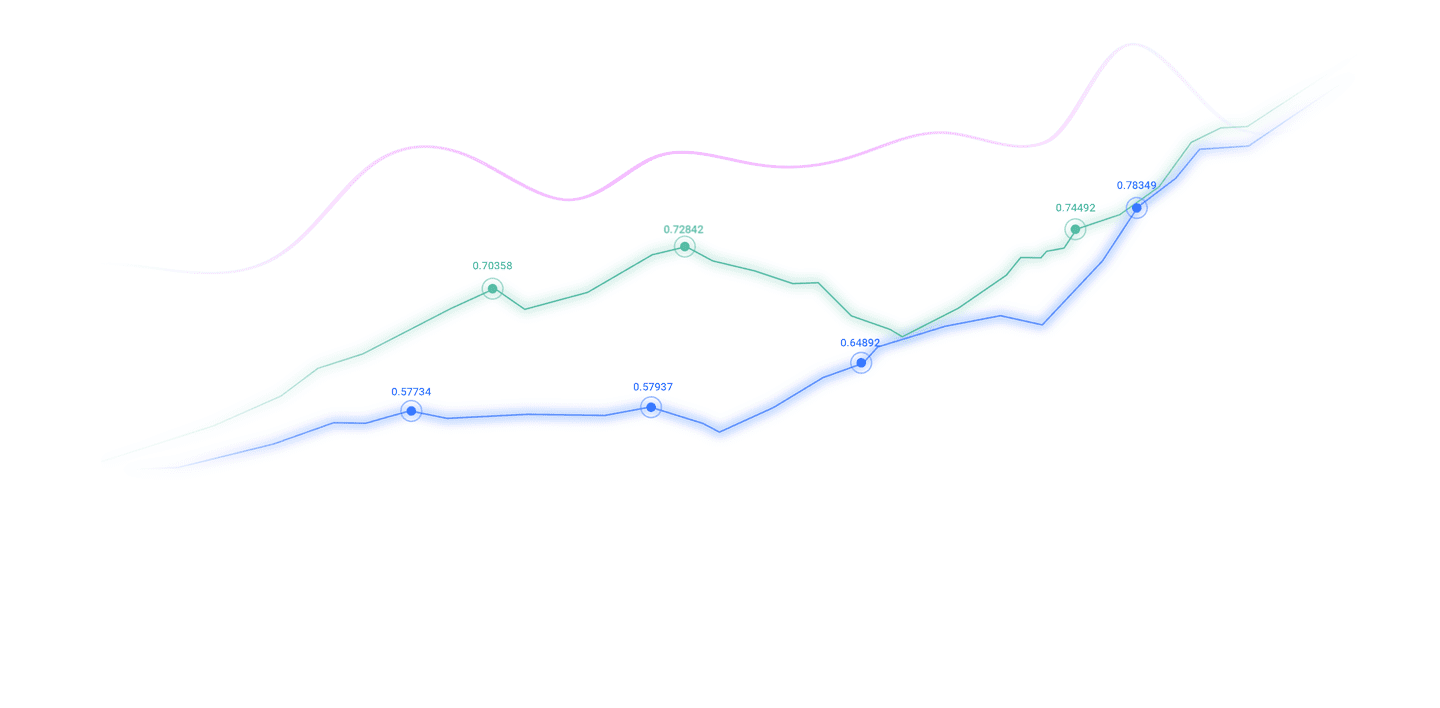

On Wednesday, the US dollar index fluctuated slightly, the market's optimism about the trade agreement faded, and the volatility of emerging Asian currencies intensified, the US dollar was under obvious short-term pressure. As the Federal Reserve and the Bank of England policy meeting approaches, investors are becoming cautious in trading, technical long and short forces are in a stalemate, and the market has entered a stage of volatile consolidation.

Analysis of major currencies

United States dollar: As of press time, the US dollar index hovered around 99.53, up 0.27% during the day. The dollar index fell by 4.3% in April, the largest in more than two years. Investors are awaiting details of what the Trump administration says is being negotiated with other countries, including China. Trump said Sunday that some agreements will be announced this week. In addition, the market is paying attention to the Fed's policy decision announced on Wednesday, and the Fed is expected to keep interest rates unchanged at the meeting, but this meeting may be the last meeting with such a clear result. Technically, if the price continues to hover near the middle track, it may maintain a wide range of 99.51-100.27 in the medium term, waiting for external events to drive it. Break risk: If you effectively break through the upper track by 100.27, you need to pay attention to the previous high point resistance; if you lose the lower track by 99.51, the medium-term trend may turn downward, and the target is aimed at the 99.00 support area. The current technical side shows that the medium-term trend is not clear, so we need to be wary of policy meetings or trade news causing breaking fluctuations.

1. Analyst: Powell may not provide much clarity

Karen Manna of Federated Hermes said that Federal Reserve Chairman Powell may not be able to satisfy investors' desire for clarity when he speaks to reporters after tomorrow's interest rate resolution. The Fed is expected to keep interest rates unchanged, and Powell may face issues of the impact of tariffs on inflation and the economy. The final level of tariffs and their duration remains unknown, which limits Powell's ability to provide more clear information. "Forecasting is always difficult, and making predictions with changing goals is almost impossible." She expects this uncertainty to continue until the Fed's June meeting unless there is any substantial change.

2. Becente: The United States is on a "warning track" of debt ceiling

On Tuesday, U.S. Treasury Secretary Becente reiterated his warning that the Treasury Department is on a "warning track" of exhausting its ability to not break the federal debt ceiling, but he did not provide a specific timetable. When we think we are approaching the so-calledWe will share it with Congress on the "X Day". "Day X" refers to the date when the Ministry of Finance will not be able to pay all government bills on time. He said the Treasury Department is still counting tax revenues for the latest tax filing season. The debt ceiling reappeared in early January, and the Treasury Department has been using special accounting operations to avoid breaking the ceiling while maintaining payments to federal debt. Wall Street analysts estimate that the Treasury Department will not need Congress to raise or shelve debt ceilings until August to October. "We are on the track of early warning," Becent said, reiterating that the U.S. government will never default and promised that the Treasury Department will not use "gimmicks" to circumvent debt ceilings.

3. The U.S. Senate xmmarkets.cnmittee promotes Bowman’s nomination for Vice Chairman of Federal Reserve Supervision

The U.S. Senate Banking xmmarkets.cnmittee promotes Michelle Bowman as Vice Chairman of Federal Reserve Supervision, bringing her one step closer to entering the approval vote. Bowman is expected to support looser banking regulations than Barr, who resigned from the position earlier this year. She often calls for “tailored” regulation and has sharply criticized a proposal that requires many banks to significantly increase their capital to buffer losses. She also said regulators should better coordinate the goals of the financial system. Earlier this year, U.S. Treasury Secretary Bescent had invited Bowman and other bank regulators to hold a private meeting with the aim of simplifying regulation.

4. The Bank of Japan plans to conduct a salary status survey on its own, which can be used as a reference factor for policy decisions. According to sources, the Bank of Japan plans to conduct a salary increase survey on its own to obtain data from small and medium-sized enterprises that do not belong to the Japan Labor Federation (Rengo), the largest trade union in Japan. Sources said the Bank of Japan will release the new study later this fiscal year, which will be part of its quarterly short-term business prosperity survey, which will begin as early as 2027. The Bank of Japan has so far relied on data released by Rengo, which investigates salary increases by collecting feedback from its employee union. Sources revealed that the Bank of Japan intends to use its independent salary increase survey results as a reference factor for deciding to raise or lower interest rates. 5. Under the shadow of Trump's tariff war, Britain and India reached a trade agreement

India and Britain reached a trade agreement aimed at strengthening the economic ties between the world's fifth and sixth largest economies. At present, Washington's destructive tariff policies continue to reshape the global trade landscape. "The conclusion of a balanced, fair and ambitious free trade agreement covering trade in goods and services is expected to significantly strengthen bilateral trade, create new jobs, improve living standards and improve the overall well-being of citizens of both countries," the Indian government said in a statement on Tuesday. "This will also unlock new potential for the two countries to jointly develop products and services for the global market." This agreement is crucial for British Prime Minister Stamer and Indian Prime Minister Modi, as countries around the world xmmarkets.cnpete to make theKeep yourself safe from Trump's tariff war. For India, the deal boosted its reputation as an emerging investment destination and attracted investors looking to diversify.

Institutional View

1. Monex: The Canadian dollar has a downside risk in the short term

Analysts at MonexEurope said in a report that the Canadian dollar faces the risk of a decline after the Federal Reserve's policy decision on Wednesday and Canadian employment data released on Friday. The Fed could suppress market bets on its rate cuts as inflation remains high and the job market remains solid. They say weak Canadian jobs data could also further accelerate the sell-off to the Canadian dollar. In contrast to last week's U.S. employment data, Canadian economic data may show some tariff-related weakness, which could strengthen expectations for the Bank of Canada's interest rate cut in June.

2. Dutch International: The decline of Norwegian krone may be limited

Dutch International Group analyst Pesolle said in a report that the Norwegian central bank may hint at its meeting on Thursday that it will start to cut interest rates soon, but any negative impact on the Norwegian krone should be temporary. He said the growing risks of economic growth mean that the Norwegian central bank could pave the way for a rate cut in June. This could prevent the Krona recovery and result in the EUR-Krona range of 11.70-11.80 for a period of time. However, he said that given the huge exchange rate advantage of the Krona and the euro looks overbought, the euro should continue to decline against the Krona. Dutch International Group aims to drop to 11.50 against the Norwegian krone by the end of the year.

3. Monex: The dollar may rise if the Fed boycotts the rate cut bet.

MonexEurope analysts said in a report that the dollar may rise if the Fed suppresses market expectations for rate cuts at its meeting on Wednesday. They said the market expected a rate cut in June, but recent U.S. data shows that the Fed is unlikely to relax its policy by the fourth quarter. Inflation remains at a high level as tariffs will further push up price pressures. The labor market remains solid, running counter to expectations of a slowdown. This leaves the Fed "with little room for action other than delaying expectations of market easing and emphasizing the resilience of potential economic conditions."

The above content is all about "[XM Foreign Exchange Decision Analysis]: The US dollar index fluctuates slightly, focusing on the Federal Reserve meeting". It was carefully xmmarkets.cnpiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here