Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-09-30

9.30 Gold accelerates to the top, waiting for the domestic market to close and p

The price of gold rose sharply until Friday after breaking through 3752. After the slight decline yesterday, it continued the rise on Friday. The price further broke through 3800, and the price has reached around 3870. From the market, gold and silver can be s...

market analysis2025-09-30

Analysis of the latest trends of gold, USD index, yen, euro, pound, Australian d

Basic news on Tuesday (September 30), the US dollar index was around 97.90; the spot gold price was around 3,868 USD/oz. On this trading day, investors will focus on U.S. job opening data, which is expected to trigger a major market trend. At 22:00 Beijing tim...

market analysis2025-09-30

The value of US gold reserves has exceeded US$1 trillion! OPEC+'s plan to increa

On Tuesday, September 30, spot gold was trading around $3,840/ounce, and gold prices broke through $3,800 per ounce for the first time on Monday, setting a record high of $3,834.03/ounce as investors bet on the U.S. to cut interest rates, concerns about a poss...

market analysis2025-09-30

Practical foreign exchange strategy on September 30

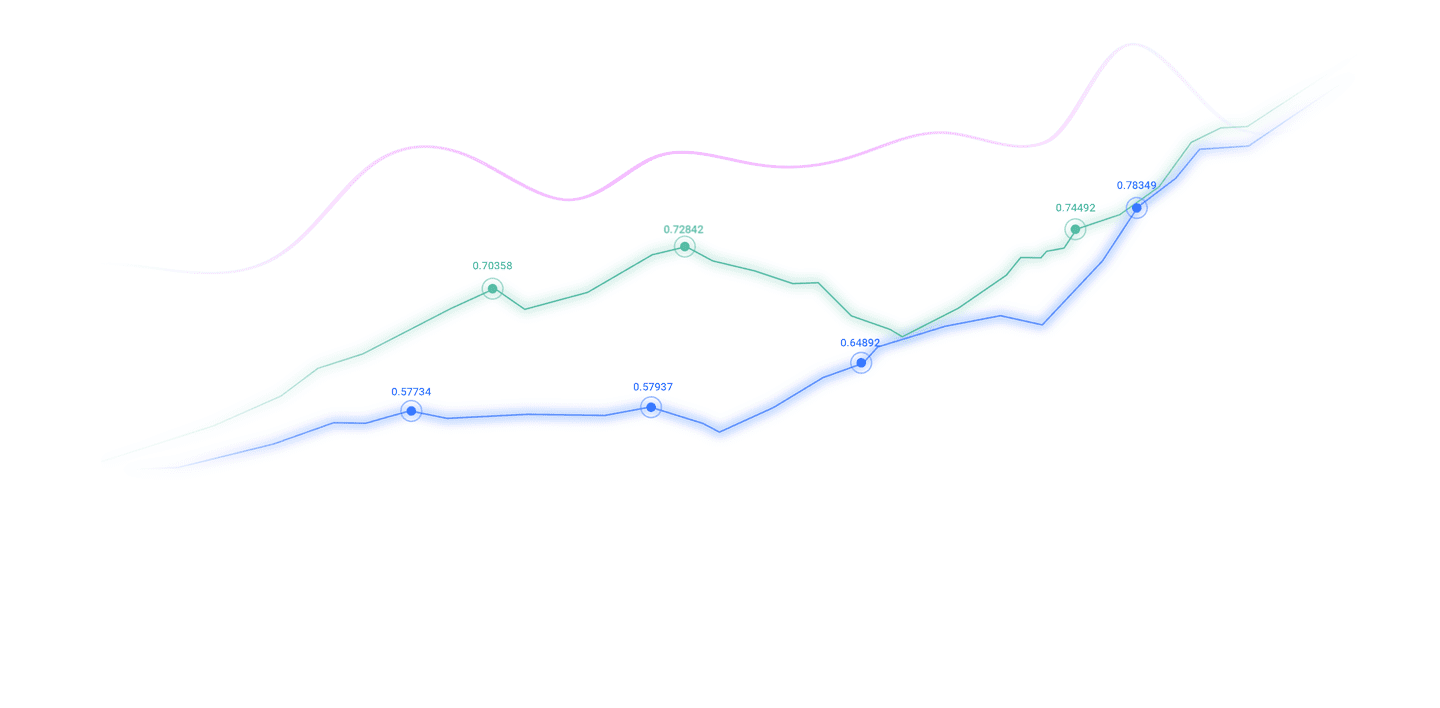

USD Index: The USD index rose below 98.20 on Monday and the decline above 97.75 was supported, meaning that the USD may maintain a downward trend after a short-term rise. If the US dollar index rises below 98.15 today and encounters obstacles, the target of fu...

market analysis2025-09-30

Will it reach 4000?

Gold continues to keep its upward thinking unchanged. In the short term, the market may have a stagnant state of consolidation, and even a slight correction, but this does not affect the overall upward pattern. The internal price is currently 863 here. Due to ...

market analysis2025-09-30

The dollar index consolidation, government shutdown risk and policy-level variab

During the European session on Monday (September 29), the US dollar index (DXY) remained around $97.95. Despite the resilience, its gains are still limited, and investors are considering the potential risk of the U.S. government shutdown and the rise in expect...

market analysis2025-09-30

Eurozone data performance is bleak, Euro/USD remains rising

During the European session on Monday (September 29), the euro/dollar maintained a moderate bullish tone, consolidating around 1.1717 after rebounding from a low of 1.1645 last week. Although euro zone confidence data failed to boost investor sentiment, market...

market analysis2025-09-30

9.30 Gold surges and crude oil plummet latest market trend analysis and today's

The same market, different guidance, different life. The characteristic of novices is that they do not understand technology and enter the market blindly. They only consider one issue each time they trade: they think that as long as they predict the market‘s r...

market analysis2025-09-30

The U.S. government will spend all its money, and both parties will fight to the

The U.S. government funds will be officially exhausted on Tuesday night. As of now, the two parties have not reached an agreement to avoid shutdowns. The crisis has entered the "last window period." If the plan cannot be finalized before 12:01 a.m. Wednesday, ...

market analysis2025-09-30

Who will implement non-agricultural and funding first? US dollar "news market" i

On Monday (September 29), the US dollar index (DXY) traded below 98 in the European session, and it was still under pressure; the external equity market futures index was relatively strong, while the price elasticity of safe-haven assets was greater, and spot ...

market analysis2025-09-30

The risk of government shutdown suppresses the market, the US dollar index falls

In the Asian session on Tuesday, the U.S. dollar index remained volatile, and the U.S. dollar fell against major currencies such as the euro and the Japanese yen on Monday, after strengthening last week as U.S. economic data was stronger than expected. The mar...

market analysis2025-09-30

Donkey elephants quarrel to push for risk aversion, gold and silver hit new high

Yesterday, the gold market continued to pull up. After the opening in the morning, the market fell first. The daily line was at the lowest point of 3759.9. After the market fluctuated strongly. The daily line reached the highest point of 3834.2 and then consol...

market analysis2025-09-30

Oil prices fell by more than 3%, OPEC+'s plan to increase production is suppress

Basic news on Tuesday (September 30, Beijing time), spot gold trading was around $3,829.18 per ounce, and gold prices broke through $3,800 per ounce for the first time on Monday, setting a record high of $3,834.03 per ounce, as investors bet on the United Stat...

market analysis2025-09-29

Gold hits a record high again, and it will be stable at 3,800 tonight.

Zheng‘s silver: Gold hits a new record high again. Tonight, 3800 is stable and has a high point. Review the market trend and technical points that appeared last Friday: First, in terms of gold: In the morning, relying on the overnight increase of 3722-3758, th...

market analysis2025-09-29

Chinese online live lectures for this week

Want to keep improving on the road of trading? The Chinese online live classroom carefully prepared by XM for you allows you to easily master the core key points, from entry to advanced, and comprehensively improve trading skills! This week‘s course highlights...

CATEGORIES

News

- 【XM Market Review】--Silver Forecast: Stuck in Volatile Range

- 【XM Group】--Gold Analysis: Market Performance Affected by Weak Liquidity

- 【XM Group】--EUR/USD Forecast: Euro Continues to Hang on Against Greenback

- 【XM Forex】--Nasdaq Forecast: Pulls Back

- 【XM Market Review】--USD/JPY Analysis: Post-BOJ Rate Hike

- 【XM Group】--USD/INR: Relative Stability as More Potential Reactions Lurk